Nika2013

Rookie

- Banned

- #41

"The strongest link between CRA lending and defaults took place in the runup to the crisis 2004 to 2006 when banks rapidly sold CRA mortgages for securitization by Fannie Mae and Freddie Mac and Wall Street." (you stated)

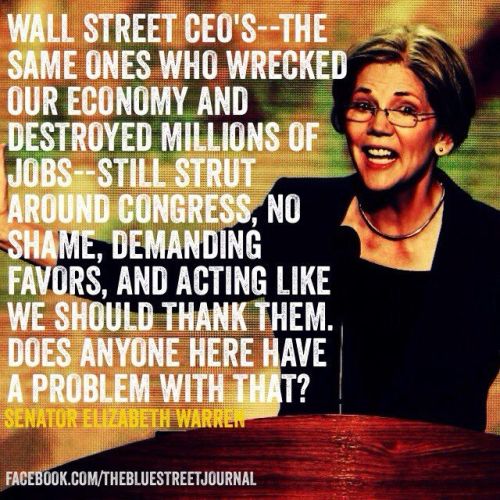

Democrats...not even in office in 2004-2006 are not responsible for financial corporations issuing trash loans that they knew would default, then dumping these on the international market to avoid foreclosures within their own institutions. Disclosure did not exist and foreign corporations believed that these loans were good and were ensured as such by US banks. Every single book that I have read on the subject from liberal authors to conservative blame the problem on deregulation by Republicans. The bail-outs were to save our economy, but also to prevent a financial domino effect throughout the global market. If you want to find the truth...just look at the savings and loan debacle of the 1980's...same actors...grabbing as much $$$ as possible before their administration left office...It repeats itself each time the Republicans are in office, but Americans have short memories.