- Thread starter

- Moderator

- #21

I've always reported my rental income. What they want is for me to bear the burden in forcing other people to report their's, which is not my problem. It's another obstacle in growing and bringing more businesses to this country.

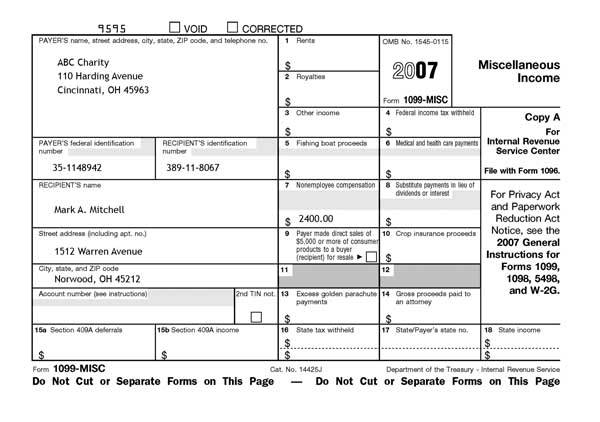

Correct, but banks already do this, as do most businesses, and auto dealers do, your employer generates forms documenting your income. All they are asking you to do is document money that you pay to contractors with a half page form. It'll take you 3 minutes.

With all due respect, you have no clue what you're talking about. There is no reason for me to rehash what the others have already said.