ScienceRocks

Democrat all the way!

- Banned

- #1

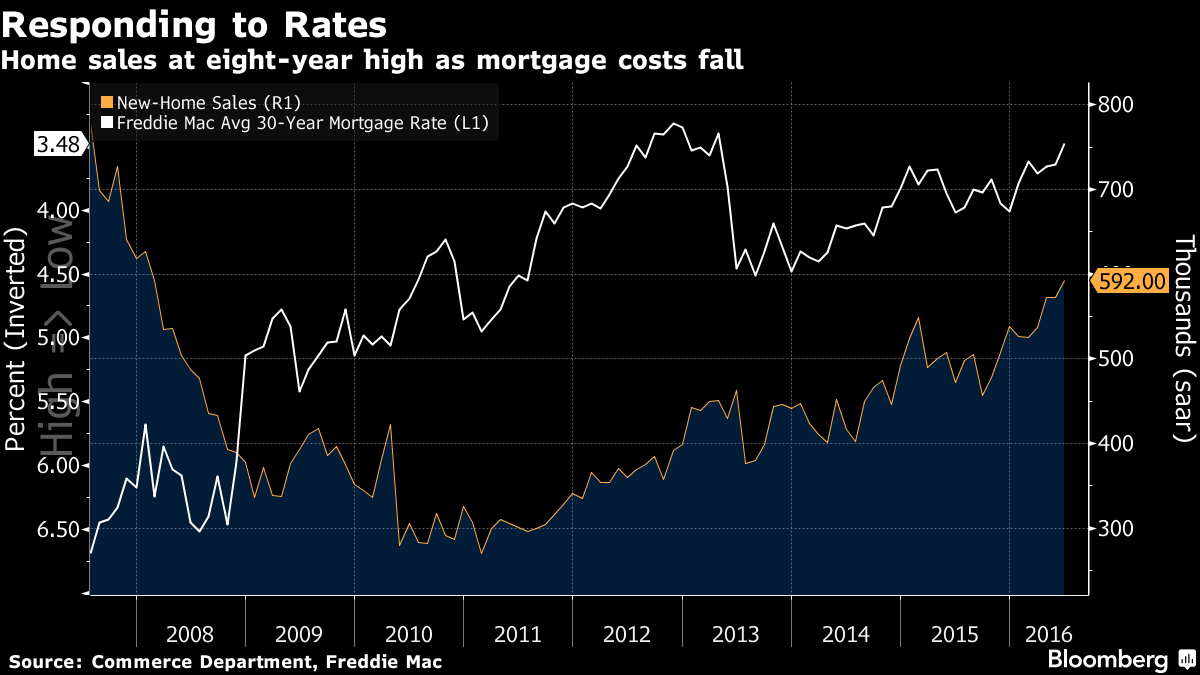

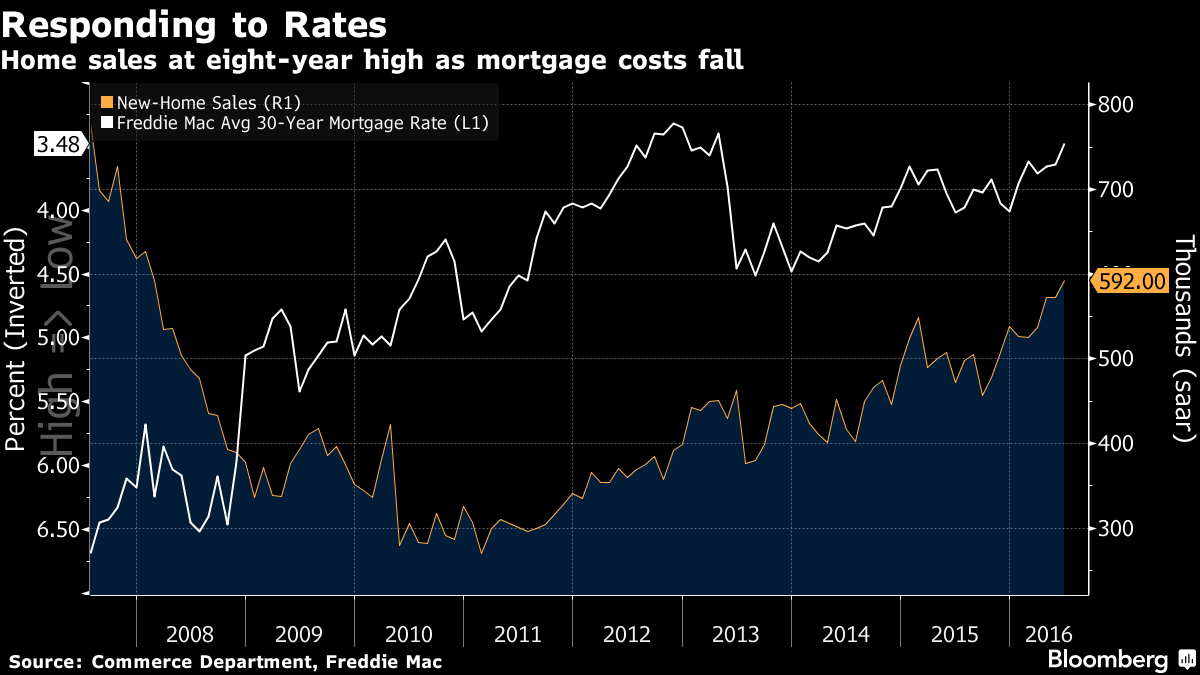

New-Home Sales in U.S. Jump to Highest Level Since February 2008

Source: Bloomberg via Chicago Tribune

Read more: New-Home Sales in U.S. Jump to Highest Level Since February 2008

Obama did a good job. thank you sir.

Source: Bloomberg via Chicago Tribune

Purchases of new U.S. single-family homes rose in June to the highest level in more than eight years, indicating a firm and resilient housing market.

Sales increased 3.5 percent to a 592,000 annualized pace, the fastest since February 2008, Commerce Department data showed Tuesday in Washington. Figures for May were revised higher. The median forecast in a Bloomberg survey called for a 560,000 rate.

While the government’s new-home purchase data are subject to big swings from month to month, the broader picture for residential real estate shows steady gains fueled by stable employment and low borrowing costs. Faster wage growth and construction of properties priced for entry-level buyers have the potential of further stoking the market.

“The grinding recovery continues,” said Brett Ryan, a U.S. economist at Deutsche Bank Securities Inc. in New York. “The fundamental underpinnings are still really supportive for housing, so it should be a steady contributor to growth over the next year or so.”

Read more: New-Home Sales in U.S. Jump to Highest Level Since February 2008

Obama did a good job. thank you sir.