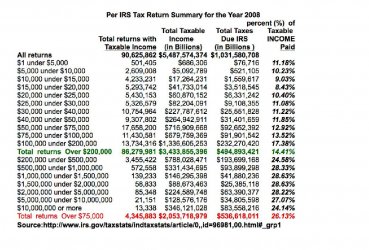

At a Senate Finance Committee hearing in May 2011, Senator Charles Grassley said, According to the Joint Committee on Taxation, 49 percent of households are paying 100 percent of taxes coming in to the federal government (meaning that the other 51 percent pay no federal tax whatsoever). At the same hearing, Cato Institute Senior Fellow Alan Reynolds asserted, Poor people dont pay taxes in this country. In 2010, Fox Business host Stuart Varney said on Fox and Friends, Yes, 47 percent of households pay not a single dime in taxes.[13]

None of these assertions are correct. As the Tax Policy Centers Howard Gleckman noted regarding a TPC estimate that almost half of Americans owed no federal income tax in 2009, rarely has a bit of data been so misunderstood, or so misused. Gleckman wrote:

The reality is that the income tax is one of a number of types of taxes that individuals pay, both over the course of their lifetimes and in a given year, and it makes little sense to treat it as though it were the only tax that matters. Some 82 percent of working households pay more in payroll taxes than in federal income taxes.[15] In fact, low- and moderate-income people pay a much larger share of their incomes in federal payroll taxes than high-income people do: taxpayers in the bottom 20 percent of the income scale paid an average of 8.8 percent of their incomes in payroll taxes in 2007, compared to 1.6 percent of income for those in the top 1 percent of the income distribution (see Figure 2).[16]

Misconceptions and Realities About Who Pays Taxes — Center on Budget and Policy Priorities

This does of course does not include everytime someone goes puts gas in the tank or performs any number of transactions that are subject to a Federal tax. Frankly, all this political talk about how the "wealthy" are the only one's paying taxes is complete nonsense as is the advocating for taxing one group of Americans including the wealthy because you believe they are not paying their fair share. It's not the rate thats the problem its the number of deductions that allows someone not to pay the existing rate. So you want to increase revenue and provide an incentive for these so called " job creators" to hire in this nation, it's easy make their tax burden rewarding when they actually create jobs in this nation. Let me explain, if for example Apple wanted to build a plant here in the United States to make iPhones the tax burden should be such that every deduction possible should be allowed, and the reverse should be true, should they choose to build those products without American labor then they should not be entitled to deductions that benefit this nation. Frankly, to raise taxes on one group of Americans for a limited return doesn't seem like a very good long term solution to a revenue problem that would seem to be much easier to fix, should our Congress come of for air from the K Street for a moment and do so.

None of these assertions are correct. As the Tax Policy Centers Howard Gleckman noted regarding a TPC estimate that almost half of Americans owed no federal income tax in 2009, rarely has a bit of data been so misunderstood, or so misused. Gleckman wrote:

The reality is that the income tax is one of a number of types of taxes that individuals pay, both over the course of their lifetimes and in a given year, and it makes little sense to treat it as though it were the only tax that matters. Some 82 percent of working households pay more in payroll taxes than in federal income taxes.[15] In fact, low- and moderate-income people pay a much larger share of their incomes in federal payroll taxes than high-income people do: taxpayers in the bottom 20 percent of the income scale paid an average of 8.8 percent of their incomes in payroll taxes in 2007, compared to 1.6 percent of income for those in the top 1 percent of the income distribution (see Figure 2).[16]

Misconceptions and Realities About Who Pays Taxes — Center on Budget and Policy Priorities

This does of course does not include everytime someone goes puts gas in the tank or performs any number of transactions that are subject to a Federal tax. Frankly, all this political talk about how the "wealthy" are the only one's paying taxes is complete nonsense as is the advocating for taxing one group of Americans including the wealthy because you believe they are not paying their fair share. It's not the rate thats the problem its the number of deductions that allows someone not to pay the existing rate. So you want to increase revenue and provide an incentive for these so called " job creators" to hire in this nation, it's easy make their tax burden rewarding when they actually create jobs in this nation. Let me explain, if for example Apple wanted to build a plant here in the United States to make iPhones the tax burden should be such that every deduction possible should be allowed, and the reverse should be true, should they choose to build those products without American labor then they should not be entitled to deductions that benefit this nation. Frankly, to raise taxes on one group of Americans for a limited return doesn't seem like a very good long term solution to a revenue problem that would seem to be much easier to fix, should our Congress come of for air from the K Street for a moment and do so.