DSGE

VIP Member

- Dec 24, 2011

- 1,062

- 30

- 71

lol --I know! I was trying to give you credit for refuting Kevin's post. As in "trying" ≠ "succeeding"....consistent with what I said...

Ah. My mistake.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

lol --I know! I was trying to give you credit for refuting Kevin's post. As in "trying" ≠ "succeeding"....consistent with what I said...

Bet on the guys with the printing presses.

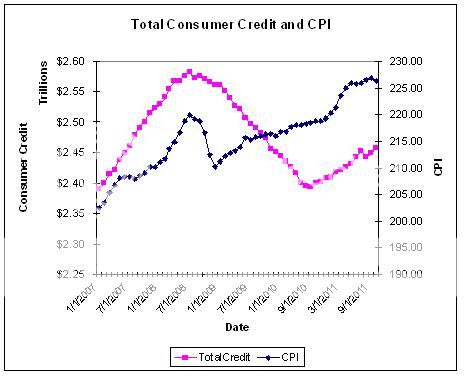

Exactly. They've come out and said they're targeting 2% PCE inflation. So what do I expect over the next few years? 2% PCE inflation.

I expect $1,000 gold before $3,000 gold....of course I could be wrong.

They're not the definitions of inflation/deflation anybody outside the Austrian school bubble uses...Well since inflation is defined as the increase in the supply of money, and deflation the decrease in the supply of money...

Here's what most people mean when they say "inflaton" (from financial definition of Inflation (economics). Inflation (economics) finance term by the Free Online Dictionary.)--

--and that means inflation has nothing to do with the money supply.Inflation

The rate at which the general level of prices for goods and services is rising.

That Mitt Romney or Ron Paul have decided that they want to change the meaning, doesn't change the meaning. It means they are being intentionally misleading in order to get votes or they are just stupid. Why would you vote for someone that intentionally lies or is stupid?

As a side note, inflation has referred to price inflation, as measured by the PCE or CPI, for over a hundred years. It does not mean monetary inflation or an increase in the money supply.