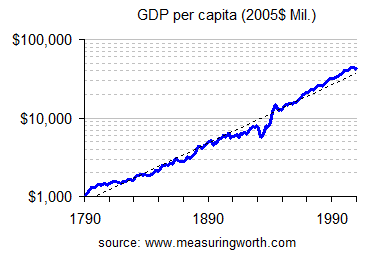

You are using nominal dollars, the real measuring stick is Real Dollarsm which the Wall Street Journal used for the threads OP. Real Dollars are used by economist as the true measuring stick. I thought you and I covered that back a month ot two ago.

1. With the current economic recession a 'blip' that will right itself shortly after the election of 2012, the people of the United States will go right back on the track of ever-increasing standard of living.

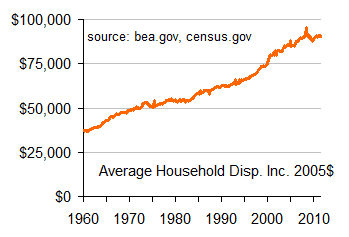

2. Lets be clear: the broadest and most accurate measure of living standard is real per capita consumption. That measure soared by 74% from 1980 to 2004. U.S. Department of Commerce. Bureau of Economic Analysis

a. A study of table 7.1 would show that between 1973 and 2004, it doubled. And between 1929 and 2004, real per capita consumption by American workers increased five fold. The fastest growth periods were 1983-1990 and 1992-2004, known as the Reagan boom.

3. That is the reason why our 'poor' are the richest poor people the world has ever known...don't you just love it when some 6% of the 'poor' have jacuzzis!!

... but don't let that stop you from your fav hobby: hand-wringing and whining.

But...why are your here? Aren't your friends waiting for you at the Wall Street protests??

The CPI in 1973 was was 42.6 the CPI in 2004 was 185.2. That means inflation grew 435%( 185.2 over 42.6), so growing the real per capita consumption by only double shows how poorly the American worker did. Thanks helping me with my point.

And that is why folks have so many more 'things'??? Inflation is 'way up' so folks have more???

The whistle on that train of thought is barely audible .

I knew this would happen when they stopped teaching logic.

A measure of inflation based on changes in personal consumption. Unlike the CPI, which is based on a fixed basket of goods, the Personal Consumption Expenditures (PCE) Deflator finds the average increase in prices for all domestic personal consumption. PCE Deflator has been shown to be a more comprehensive and consistent gauge of inflation in the US. PCE Deflator, (Personal Consumption Expenditure Deflator) - United States

a. The official inflation measures overstate inflation: using the PCE deflator the gain from 1977 to 2005 increases by 50%.

Welcome to the party.

Welcome to the party.