The Middle Class should a class action law suit against Plutocrats & the Rich for being forced to subsidize the Rich with taxes. Strip them of the wealth they have acquired via the tax subsidy, racketeering & unfair business trade practice. Are there any lawyers here that will help file?

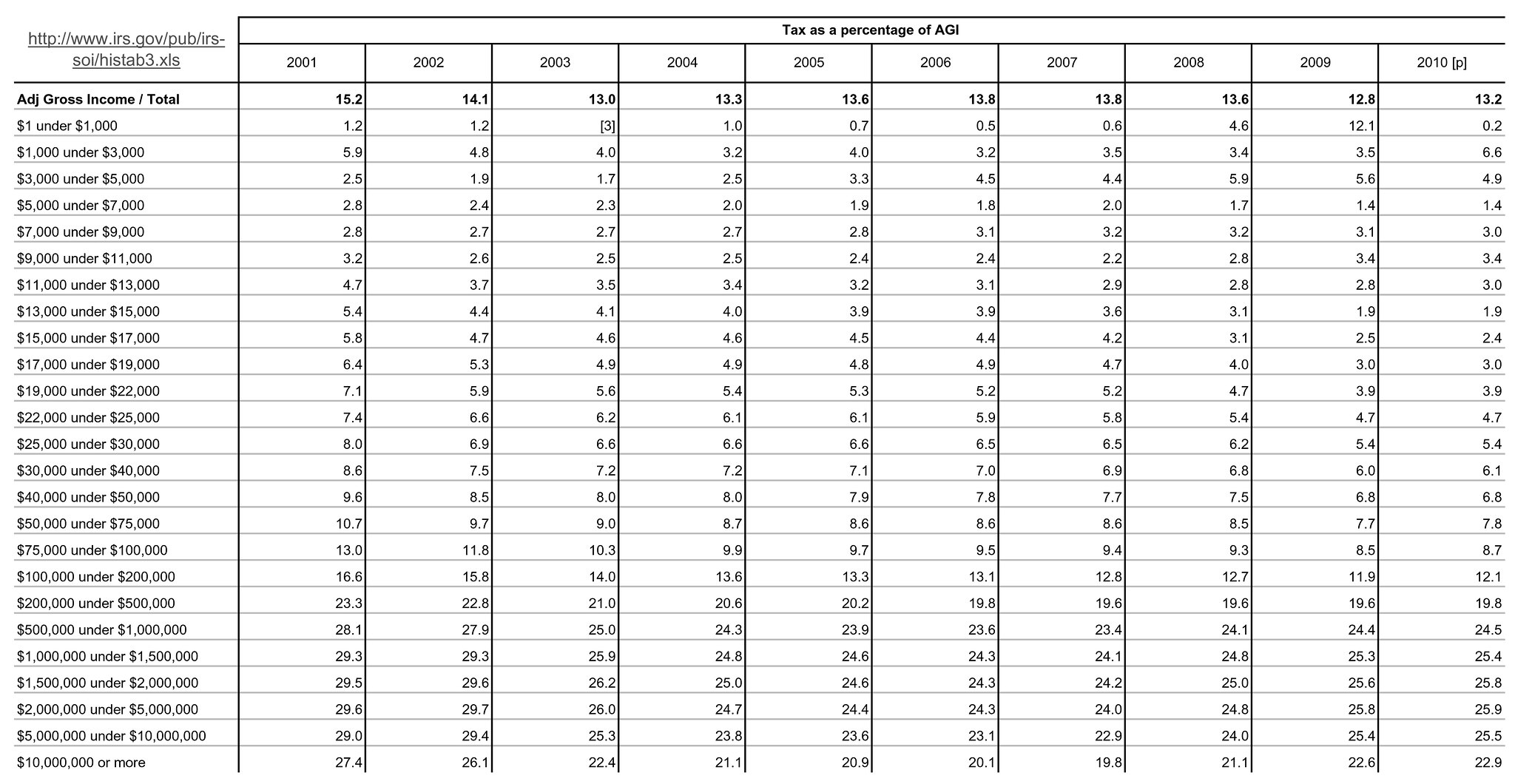

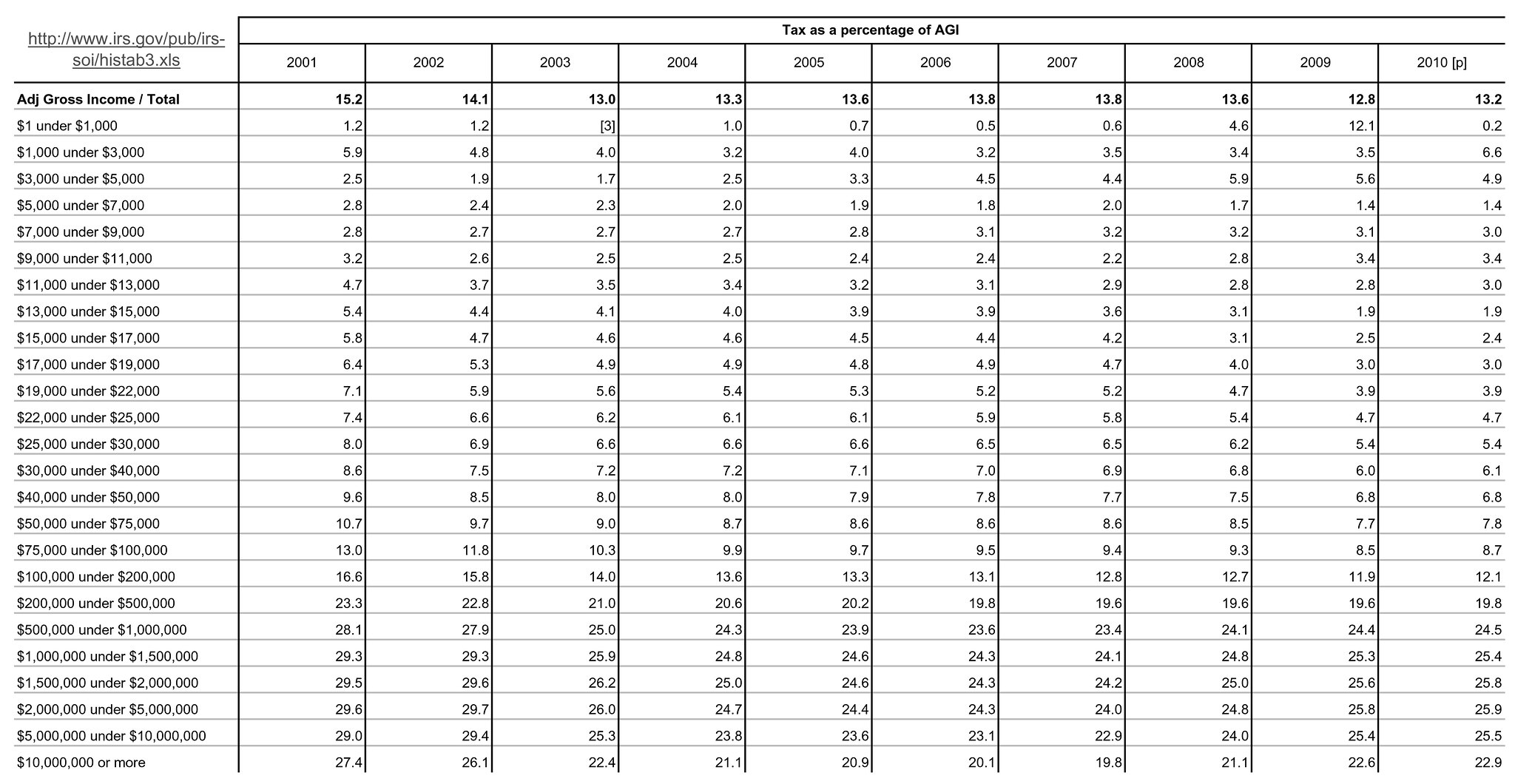

Facts from the IRS: From 2001 to 2007 the people with the highest income got the biggest percentage cuts in their actual tax payments. The middle class had to subsidize the rich even more than before. It is time to end the tax subsidy to the rich. The middle class is tired of carrying your fat ass along with the poor. Get off the back of the Middle Class & help us carry the poor.

If a rich person Mitt Romney only pays 13% & a middle class person KissMy pays 28%, the middle class is subsidizing the rich.

It is the same as when tax on ethanol was 25 cents a gallon & gasoline tax was 45 cents a gallon. You people screamed that we were subsidizing ethanol even when ethanol was being taxed.

There is no way in hell a middle class person paying 28% tax can produce widgets cheaper than a rich person only paying 13% tax. This tax rate causes the middle class to go out of business & the rich takes over the entire market. The middle class business owner & workers are forced into poverty & onto the government dole that the rich refuses to pay for.

Facts from the IRS: From 2001 to 2007 the people with the highest income got the biggest percentage cuts in their actual tax payments. The middle class had to subsidize the rich even more than before. It is time to end the tax subsidy to the rich. The middle class is tired of carrying your fat ass along with the poor. Get off the back of the Middle Class & help us carry the poor.

If a rich person Mitt Romney only pays 13% & a middle class person KissMy pays 28%, the middle class is subsidizing the rich.

It is the same as when tax on ethanol was 25 cents a gallon & gasoline tax was 45 cents a gallon. You people screamed that we were subsidizing ethanol even when ethanol was being taxed.

There is no way in hell a middle class person paying 28% tax can produce widgets cheaper than a rich person only paying 13% tax. This tax rate causes the middle class to go out of business & the rich takes over the entire market. The middle class business owner & workers are forced into poverty & onto the government dole that the rich refuses to pay for.

Last edited: