Antiderivative

Rookie

- Apr 17, 2011

- 1,616

- 103

- 0

- Banned

- #1

What is the marginal productivity of debt? Antal E. Fekete explains it.

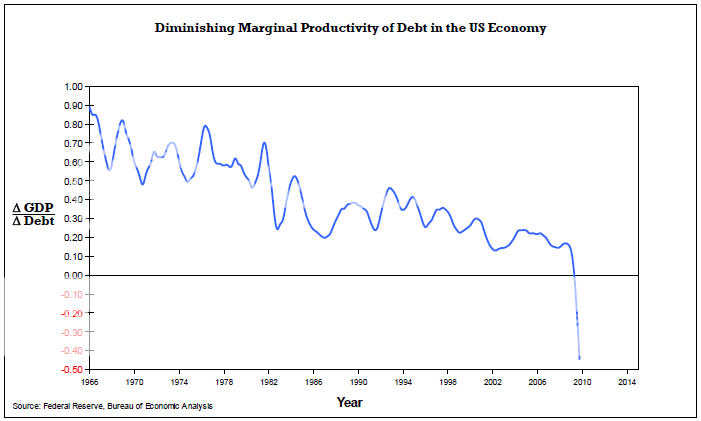

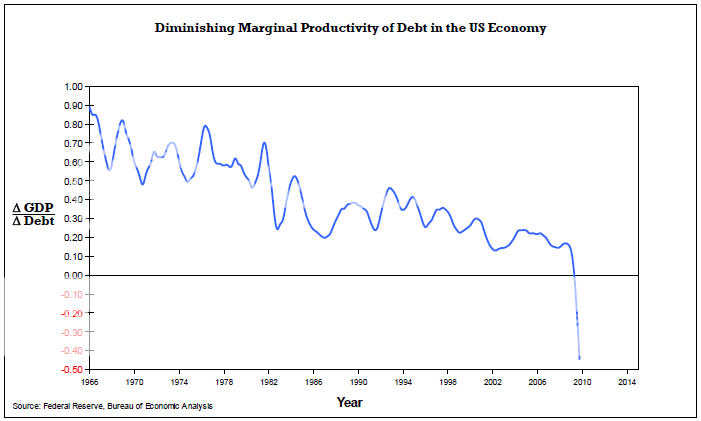

As Christopher Rupe has shown, the marginal productivity of debt is now negative.

My Thoughts on the Diminishing Productivity of Debt | The Financial Minority Report

"The Marginal Productivity of Debt" by Antal E. Fekete. FSO Editorial 03/30/2009The key to understanding the problem is the marginal productivity of debt, a concept curiously missing from the vocabulary of mainstream economics. Keynesians take comfort in the fact that total debt as a percentage of total GDP is safely below 100 in the United States while it is 100 and perhaps even more in some other countries. However, the significant ratio to watch is additional debt to additional GDP, or the amount of GDP contributed by the creation of $1 in new debt. It is this ratio that determines the quality of debt. Indeed, the higher the ratio, the more successful entrepreneurs are in increasing productivity, which is the only valid justification for going into debt in the first place.

Conversely, a serious fall in that ratio is a danger sign that the quality of debt is deteriorating, and contracting additional debt has no economic justification. The volume of debt is rising faster than national income, and capital supporting production is eroding fast. If, as in the worst-case scenario, the ratio falls into negative territory, the message is that the economy is on a collision course and crash in imminent. Not only does more debt add nothing to the GDP, in fact, it causes economic contraction, including greater unemployment. The country is eating the seed corn with the result that accumulated capital may be gone before you know it. Immediate action is absolutely necessary to stop the hemorrhage, or the patient will bleed to death.

As Christopher Rupe has shown, the marginal productivity of debt is now negative.

My Thoughts on the Diminishing Productivity of Debt | The Financial Minority Report