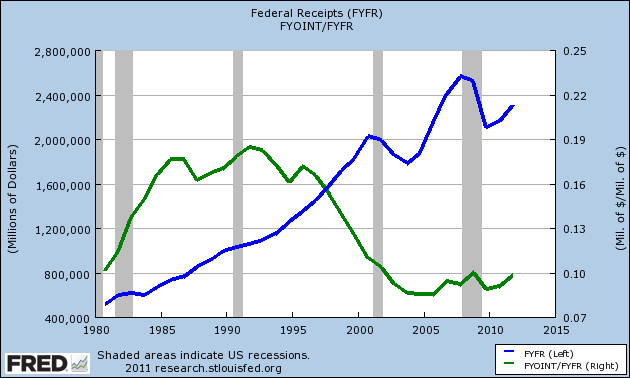

I knew nothing about gold until I picked up an article in January 2002 on gold supply and how there hadn't been any new mines built since 1995. Within a year, I was the largest owner of gold stocks in the SE, or so I was told, and they represented 10% of my fund.

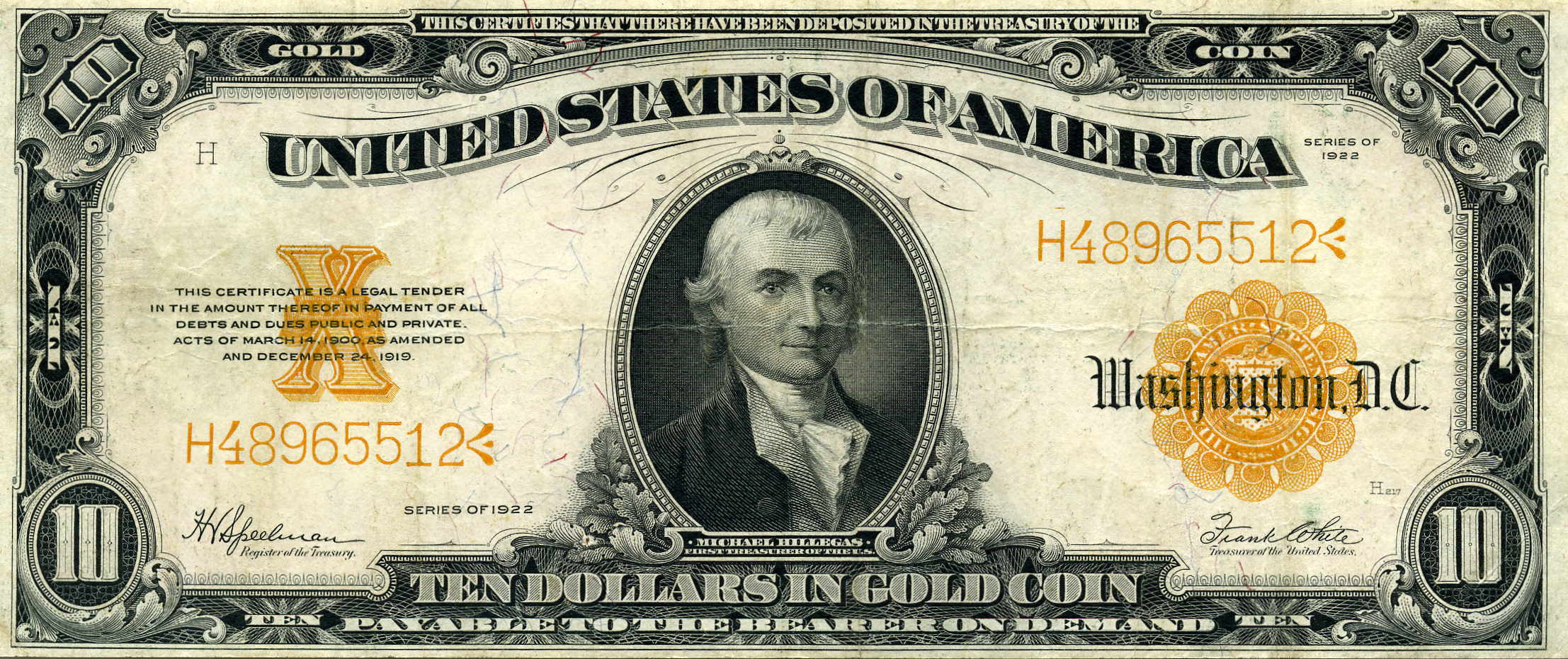

A good investment is a bad basis for a currency.