Skull Pilot

Diamond Member

- Nov 17, 2007

- 45,446

- 6,163

- 1,830

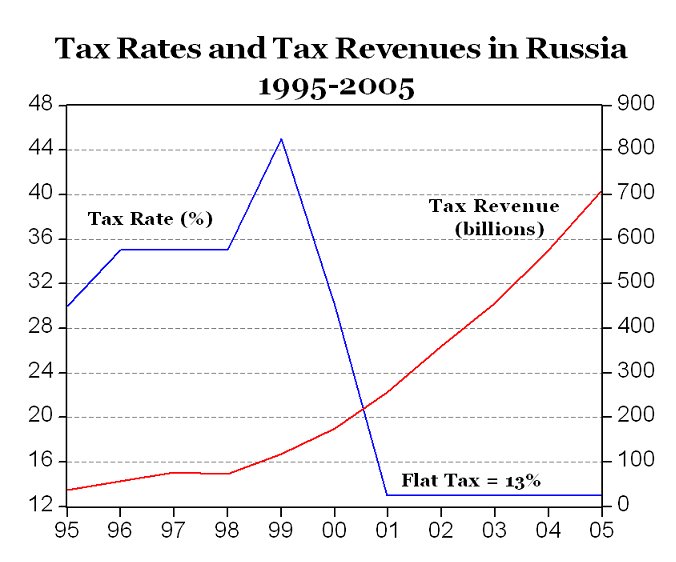

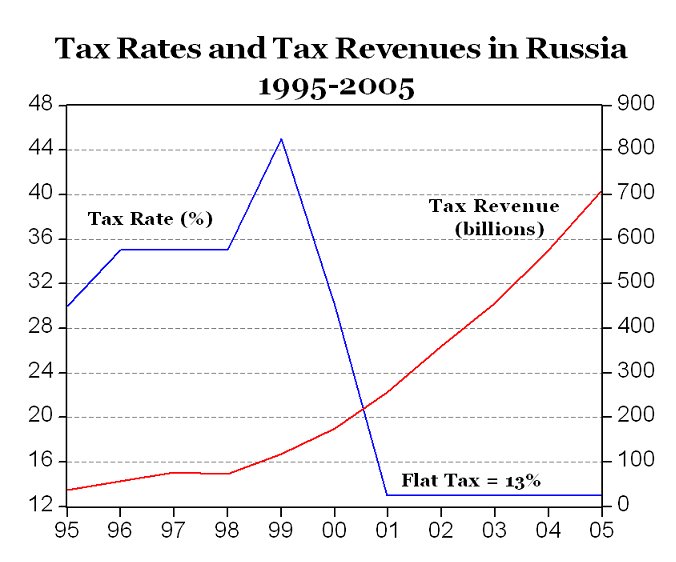

All the supporters for so called progressive punitive taxes have some bitter pills to swallow with the undeniable success of the flat tax in other countries.

The Rise Of The Flat Tax Gives Us Morning In Albania - Forbes

Here's a simple example

Summary of Latest Federal Individual Income Tax Data | Tax Foundation

In 2009 the total income tax revenue was 865.8 Billion

In 2009 the total of all personal income was about 12 Trillion dollars.

Total Personal Income U.S. and All States

That works out to an effective tax rate of about 7% on all personal income.

This is not AGI mind you but gross personal income.

If we instituted a flat tax of of 10% on all personal income our tax revenue in 2009 would have been 1.2 Trillion dollars.

If we lower the corporate income tax to the same flat rate we'll see even more revenue as businesses will no longer have incentive to keep money off shore.

Our taxes would be simple to file and there is absolutely no room to cheat or evade taxes.

We would be able to gut the IRS and save billions of dollars.

We wouldn't have to hire accountants and tax attorneys anymore.

And we get to keep 90% of what we earn every year.

How can anyone oppose this simple yet elegant plan?

The Rise Of The Flat Tax Gives Us Morning In Albania - Forbes

Here's a simple example

Summary of Latest Federal Individual Income Tax Data | Tax Foundation

In 2009 the total income tax revenue was 865.8 Billion

In 2009 the total of all personal income was about 12 Trillion dollars.

Total Personal Income U.S. and All States

That works out to an effective tax rate of about 7% on all personal income.

This is not AGI mind you but gross personal income.

If we instituted a flat tax of of 10% on all personal income our tax revenue in 2009 would have been 1.2 Trillion dollars.

If we lower the corporate income tax to the same flat rate we'll see even more revenue as businesses will no longer have incentive to keep money off shore.

Our taxes would be simple to file and there is absolutely no room to cheat or evade taxes.

We would be able to gut the IRS and save billions of dollars.

We wouldn't have to hire accountants and tax attorneys anymore.

And we get to keep 90% of what we earn every year.

How can anyone oppose this simple yet elegant plan?