Campbell

Gold Member

- Aug 20, 2015

- 3,866

- 646

- 255

..............................................Total U S Debt................................................

Figures Easily Verified....Taken From the Bureau of the Debt

US: $18,775,084,981,440 - Debt as of December 2015?

09/30/2014 $17,824,071,380,733.82

09/30/2013 $16,738,183,526,697.32

09/30/2012 $16,066,241,407,385.89

09/30/2011 $14,790,340,328,557.15

09/30/2010 $13,561,623,030,891.79

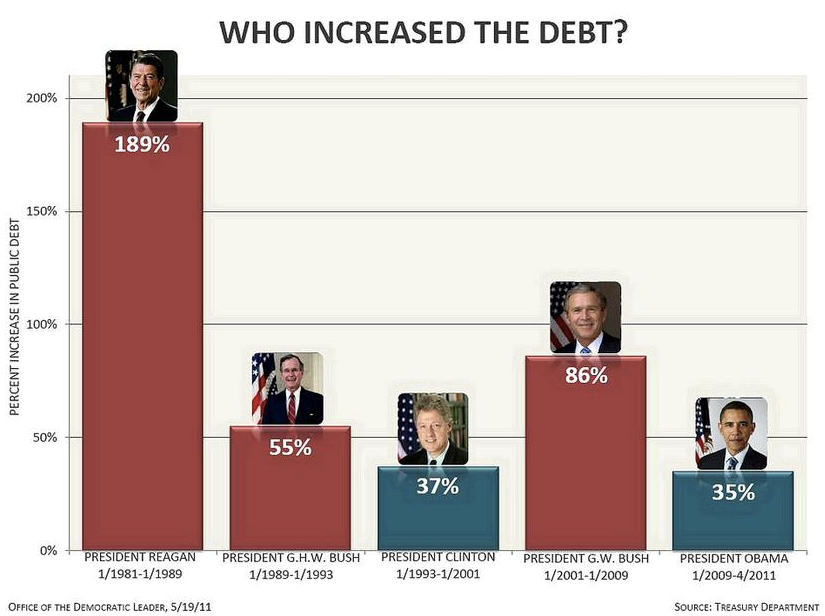

09/30/2009 $11,909,829,003,511.75(80% Of All Debt Across 232 Years Borrowed By Reagan And Bushes)

09/30/2008 $10,024,724,896,912.49(Times Square Debt Clock Modified To Accommodate Tens of Trillions)

09/30/2007 $9,007,653,372,262.48

09/30/2006 $8,506,973,899,215.23

09/30/2005 $7,932,709,661,723.50

09/30/2004 $7,379,052,696,330.32

09/30/2003 $6,783,231,062,743.62(Second Bush Tax Cuts Enacted Using Reconciliation)

09/30/2002 $6,228,235,965,597.16

09/30/2001 $5,807,463,412,200.06(First Bush Tax Cuts Enacted Using Reconciliation)

09/30/2000 $5,674,178,209,886.86(Administration And Congress Arguing About How To Use Surplus)

09/30/1999 $5,656,270,901,615.43(First Surplus Generated...On Track To Pay Off Debt By 2012)

09/30/1998 $5,526,193,008,897.62

09/30/1997 $5,413,146,011,397.34

09/30/1996 $5,224,810,939,135.73

09/29/1995 $4,973,982,900,709.39

09/30/1994 $4,692,749,910,013.32 (Bill Clinton Raised Taxes On The Rich early 1993)

09/30/1993 $4,411,488,883,139.38 ( Debt Quadrupled By Reagan/Bush41)

09/30/1992 $4,064,620,655,521.66

09/30/1991 $3,665,303,351,697.03

09/28/1990 $3,233,313,451,777.25

09/29/1989 $2,857,430,960,187.32

09/30/1988 $2,602,337,712,041.16

09/30/1987 $2,350,276,890,953.00

09/30/1986 $2,125,302,616,658.42

09/30/1985 $1,823,103,000,000.00

09/30/1984 $1,572,266,000,000.00

09/30/1983 $1,377,210,000,000.00

09/30/1982 $1,142,034,000,000.00(Total Debt Passes $1 Trillion)(Reagan Slashed Tax Rates To Pre Depression Levels)

09/30/1981 $997,855,000,000.00

Last edited: