Wonky Pundit

USMB's Silent Snowden

- Thread starter

- #21

This is not an economics thread, it's a religious thread for the Church of Doom'n'Gloom and everyone's singing their favorite hymns "All is Lost" and "Ain't it Awful." Rev. Wonky Pundit reads from the sacred CNN text the following:Some people just dont understand the economy

No one understands the economy. Some of us are smart enough to realize that, the rest believe the idiots that tell them they get it.

Pure fanatical mindless religion.every neighbor of yours is sitting on a pile of debt (most likely living in it -- in an upside down house) and can't spend. In turn, banks are sitting on portfolios of bad debt...

Of course from an economics standpoint it's not true, but I'm not sure if Rev. Wonky and CNN know they're lying or they're just that stupid. Reality of course (you know like, actual loan balances and bank accounts) is that some of our neighbors owe money to banks and some of them own the banks, and while our average neighbor may owe $45,194, he's also got $234,307 stashed away so even after paying off all debts he's still got $189,113.

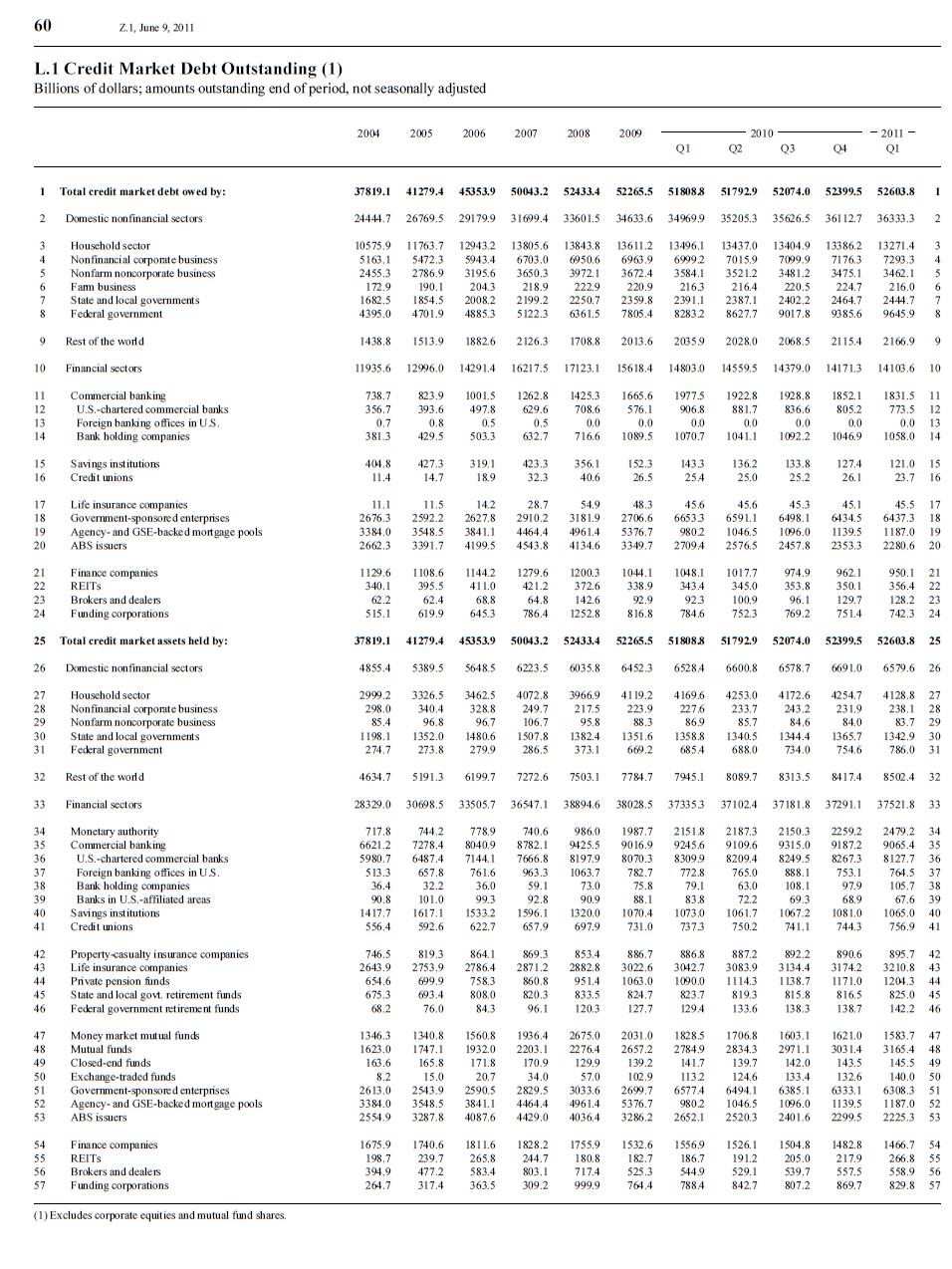

fwiw, that goofy debt/gdp number is total debt divided by GDP = $53T/$15T = over three hundred percent. That $53T debt is the $13T that households owe plus the $40T businesses owe, and it's owed to you and I and our neighbors and our businesses. This stuff is all in the latest Fed Flow of Funds Report --it's a 497 KB pdf but they got other format choices on this page. Total debt is on page 60 and household balances are on page 104.

Aside from the fact that you're a troll, so what? Debt is debt. It discourages investment. Or did the school from which you earned your Cracker Jack diploma fail to mention that?

See, I can do it too.