320 Years of History

Gold Member

I just read a thread in which another member wrote the following:

In another thread, I found myself having to write the following:

That wasn't my first answer to the member's inquiry. I thought initially s/he was unclear about the "ppm" abbreviation's meaning and context. I was wrong. That the ppm of CO2 was with regard to that compound's existence in air -- as opposed, perhaps, to rocks, water, dirt, etc. -- was the source of the member's uncertainty. Well, what can I say? I'm happy s/he got the information needed; that was the point of my bothering to answer the question.

I have to admit that it is variously frustrating and boring to find oneself in a political forum aiming to have a substantive discussion about XYZ topic that captures one's interest, only to find that some of the folks who are most willing to participate in the discussion routinely make remarks that show they need to be educated on the topic before either of you can get to having a meaningful debate/discussion. I'm not referring to learning what opinions are held by this or that proponent/opponent of a given policy; I mean just knowing the basic facts that have been long established and proven.

I'm not alone in not knowing about certain topics. One member seems to be quite "into" high finance topics. I don't generally have anything to say in those threads because I'm not all that interested in sophisticated financial investing topics; thus I don't know that much about it. And being uninterested in it, I don't intend to go find out about them in order to have a coherent/substantive discussion about them and their impacts. For other topics I didn't know much about them, but I care about them enough to research them. And yet other topics required little more than finding readily accessible credible/scholarly (not editorial) papers to include in my posts merely because I know that nobody here knows anything about me or what know "inside out" and what don't; thus I can't legitimately just say "XYZ is so" and expect to be taken seriously solely because "I" said so. (I can do that in my professional life, but my audience knows me. Y'all don't....that's got a lot to do with why many of my posts are long.)

At some point of late, I have come realize that in so much political discourse, understanding "the basics" is what so many lay writers and actual or would-be politicians either don't understand or ignore/disbelieve them even though they do understand them. Foremost among the subjects that I've noticed that happening is economics. For example:

The aforementioned illustrations aside, let's return more directly to why I wrote what's above and cited the other member's and my own remarks at the start of this post (Note: it's not to discuss whether anyone aims to educate folks here)....

Researchers, in a report prepared for the National Council on Economic Education, state that 34% of respondents scored an "A" or "B" on an economics quiz that at best represents the tip of the iceberg of what constitutes "the basics" of economics.

All the more surprising is that 50% of the respondents indicated they had studied economics. That is surprising because the nature of the questions is exceedingly simple; one would expect, given the simplicity of the questions and having studied econ, at least 50% of the adults in the survey to have scored an "A" or "B" on the quiz. In fact, most of the quiz questions ask about the handful of things that are accurately intuited about economic principles. In my and others' opinion, a lot about economics isn't intuitive at all; one has to actually study and think pretty carefully about most econ principles and concepts. (If you were a "curve buster" in an econ class, or endured the outcome of there being a two or three of them in your econ class, you know what I'm talking about.) The impact of free trade vs. constrained trade is one such thing. (If you click on the preceding link, you'll find a discussion of the theory (science sense of the word) of comparative advantage along with a very good depiction intended for skeptics of free trade's net benefits over restricted trade.)

That study linked above is just one that discusses the insufficiency manifest among Americans in general when it comes to economic topics. Given their dearth of basic economic awareness, just how do folks justifiably ascribe to ideas such as "the middle class have been defrauded by the elite?" (Power elite, intellectual elite, monied elite, insiders, etc.) By what means do they know? Because someone who is among one of the "elite" says so in an effort to garner the "non elite's" support?

The fact is that nobody has misled the American people. What has happened is that people have allowed themselves to believe for topics that it's all "really quite simple." Well, making sense of those topics and how to manage one's affairs re: them is pretty simple if one understands them, but clearly, for many topics, most particularly economics and science, most folks don't. Even worse, they don't bother to get well informed (even at a basic level) on the topic. And the terrible thing about that is that it's just not that hard to do for a wide variety of subject. The factual and objective information is there for the taking.

I don't visit this site to educate people on the basics.

[The question the member asked in a thread broadly themed on climate change] was "Parts of CO2 per million of what?" The OP is about CO2 in the Earth's atmosphere. That makes the "what" be air, thus X parts of C02 per million liters of air.

I have to admit that it is variously frustrating and boring to find oneself in a political forum aiming to have a substantive discussion about XYZ topic that captures one's interest, only to find that some of the folks who are most willing to participate in the discussion routinely make remarks that show they need to be educated on the topic before either of you can get to having a meaningful debate/discussion. I'm not referring to learning what opinions are held by this or that proponent/opponent of a given policy; I mean just knowing the basic facts that have been long established and proven.

I'm not alone in not knowing about certain topics. One member seems to be quite "into" high finance topics. I don't generally have anything to say in those threads because I'm not all that interested in sophisticated financial investing topics; thus I don't know that much about it. And being uninterested in it, I don't intend to go find out about them in order to have a coherent/substantive discussion about them and their impacts. For other topics I didn't know much about them, but I care about them enough to research them. And yet other topics required little more than finding readily accessible credible/scholarly (not editorial) papers to include in my posts merely because I know that nobody here knows anything about me or what know "inside out" and what don't; thus I can't legitimately just say "XYZ is so" and expect to be taken seriously solely because "I" said so. (I can do that in my professional life, but my audience knows me. Y'all don't....that's got a lot to do with why many of my posts are long.)

At some point of late, I have come realize that in so much political discourse, understanding "the basics" is what so many lay writers and actual or would-be politicians either don't understand or ignore/disbelieve them even though they do understand them. Foremost among the subjects that I've noticed that happening is economics. For example:

- Trade: Judging by the frequency with which we hear current politicians grousing about how free trade has been detrimental to the American economy, and the extent of support for free trade, one must infer that most folks simply refuse to accept free trade does more good than harm to an economy.

Let's look at the basics of free trade.

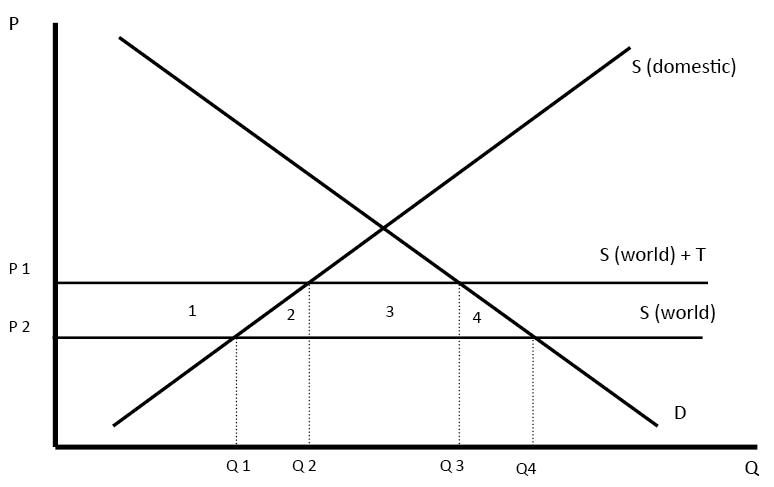

P = price; Q = quantity; S = supply; D = demand; T = tariff

(For you math whizzes, yes, economists see quantity supplied as a function of price, even though economists present their graphs "backwards.")

- The removal of tariffs leads to lower prices for consumers (Prices fall from P1 to P2)

- This fall in prices enables an increase in consumer surplus of areas 1 + 2 + 3 + 4

- Imports will increase from Q3-Q2 to Q4-Q1

- The government will lose tax revenue of area 3. Tax revenue from imports was T (P1-P2) × (Q3-Q2)

- Domestic firms producing this good will sell less and lose producer surplus equal to area 1

- However overall there will be an increase in economic welfare of (2+4) (calculated as (1+2+3+4) – (1+3))

- The magnitude of this increase depends upon the elasticity of supply and demand. If demand elastic consumers will have a big increase in welfare

- Essentially, removing tariffs leads to lower prices for consumers – so the price of imported food, clothes and computers will be cheaper.

Free trade has become the scapegoat for politicians and voters. Free trade, they say, is the reason so many folks are unemployed or not employed as they would like to be (mis-/under employed). It's no wonder that it is. It's easy to point the finger at free trade because most folks aren't aware of the empirical underpinnings of how free trade actually works. Additionally and with beguiling intuitiveness, if producer moves its factory to another nation because wages are lower there, the person who lost their job thinks free trade is the cause.

Now one can take the basic principles above and test them by collecting data directly from the marketplace and measuring what impact(s) in fact a given free trade agreement has had on labor supply/suppliers. That, in fact, has been done. (Note, what follows is a listing of studies that examine and report what is, not what folks think about what is being what it is. In other words, it is not a listing of editorials/opinions.)

Sure a God made little green apples, I understand why individuals en masse grouse about free trade. As individuals, they see only that the labor they each have to supply is no longer in demand in the place where they are of a mind to supply it. That sucks if one is among those individuals. The thing is that free trade, indeed macroeconomics in general, doesn't care about John Brown or Margaret Green; it cares about and speaks to the state of an economy as a whole. Does that mean John and Margaret may get the short end of the stick? Yes, if they don't behave in a economically rational way, they most certainly may. The other thing is that elected leaders cannot reasonably be expected to manage the economy to John and Margaret's benefit; they must do so with regard to the economy on the whole.

Looking at some of the basics of free trade depicted above:

So where does that leave John and Margaret? Well, if they are willing to behave in an economically rational way, they have a few choices:

I'm no different than John and Margaret. I was part of the flood of business transformation projects that happened in the U.S. in the 1990s. U.S. companies were on the forefront of that process; thus I knew there would come a day when the U.S. companies that buy my (my competitors' similar) services will nearly all have completed their evolution to 21st century models. That is part and parcel why I began in the mid-1990s to build my skills and contacts for doing so outside the U.S. when the U.S. market for my services/skills dried up/contracted.

For today's up and coming workers, it should be blatantly apparent that globalization is here to stay. What does that mean? Well, I can't predict all the things it means for any specific individual, but one thing I can say is that the places in the world that haven't matured as has the U.S and Western Europe have are the places where the most rapid growth will occur. That's just how business/economic cycles work as they move from nascence to maturity, and each of us must apply that concept to our own situation.

If one is an American and wants to be part of that growth and reap some of the rewards, speaking one of the languages spoken where that growth will happen is going to be a big a plus, if not a necessity. I got started working internationally that I didn't have to speak anything other than English. My kids, however, will have to fluently speak something in addition to English, be it Spanish, Hindi or Mandarin/Cantonese or some other language, perhaps Arabic.

Sidebar:

Now one can take the basic principles above and test them by collecting data directly from the marketplace and measuring what impact(s) in fact a given free trade agreement has had on labor supply/suppliers. That, in fact, has been done. (Note, what follows is a listing of studies that examine and report what is, not what folks think about what is being what it is. In other words, it is not a listing of editorials/opinions.)

- April 2015: The North American Free Trade Agreement (Congressional Research Service)

- January 2016: NAFTA's Economic Impact (Council on Foreign Relations)

- May 2014: NAFTA at 20 (Peterson Institute for International Economics)

- March 2004: NAFTA and its Impact on the United States

- Winter 2001: The Impact of NAFTA on the United States

- December 2013: Econometric Estimates of the Effects of NAFTA: A Review of the Literature (not a study, but rather a high level review of existing credible studies and analyses.)

Sure a God made little green apples, I understand why individuals en masse grouse about free trade. As individuals, they see only that the labor they each have to supply is no longer in demand in the place where they are of a mind to supply it. That sucks if one is among those individuals. The thing is that free trade, indeed macroeconomics in general, doesn't care about John Brown or Margaret Green; it cares about and speaks to the state of an economy as a whole. Does that mean John and Margaret may get the short end of the stick? Yes, if they don't behave in a economically rational way, they most certainly may. The other thing is that elected leaders cannot reasonably be expected to manage the economy to John and Margaret's benefit; they must do so with regard to the economy on the whole.

Looking at some of the basics of free trade depicted above:

- Do you see anything indicating free trade's goal or direct impacts have anything to do with labor? If you answered, "Yes. Free trade lowers the price of labor supplied/purchased in the market under consideration," you'd be correct.

- Now ask yourself this.

- Is a producer more or less likely to stay in business with higher or lower production costs?

- Regardless of what one earns, will consumers find it easier or harder to purchase goods/services when prices are lower than they otherwise would be?

- Now consider this:

- Given the critical importance of comparative advantage in determining the gains from (free) trade, why is it that one rarely hears free trade's detractors make even a fleeting effort to identify what are America's comparative advantages?

The answer is simple, but providing it dismays politicians who know damn well that the majority of their electorate don't have the first idea of what comparative advantage is. All most of those folks know is that they don't have the job they used to have or want to have. Pols usually know too that the truthful answer isn't all that comforting to "John" and "Margaret."

- Given the critical importance of comparative advantage in determining the gains from (free) trade, why is it that one rarely hears free trade's detractors make even a fleeting effort to identify what are America's comparative advantages?

So where does that leave John and Margaret? Well, if they are willing to behave in an economically rational way, they have a few choices:

- Supply a different kind of labor where they are.

- Go to where the kind of labor they supply is in demand.

- Go into business for themselves, thus becoming buyers and sellers of labor rather than solely sellers (producers) of it.

- Do none of those things and suffer the consequences.

I'm no different than John and Margaret. I was part of the flood of business transformation projects that happened in the U.S. in the 1990s. U.S. companies were on the forefront of that process; thus I knew there would come a day when the U.S. companies that buy my (my competitors' similar) services will nearly all have completed their evolution to 21st century models. That is part and parcel why I began in the mid-1990s to build my skills and contacts for doing so outside the U.S. when the U.S. market for my services/skills dried up/contracted.

For today's up and coming workers, it should be blatantly apparent that globalization is here to stay. What does that mean? Well, I can't predict all the things it means for any specific individual, but one thing I can say is that the places in the world that haven't matured as has the U.S and Western Europe have are the places where the most rapid growth will occur. That's just how business/economic cycles work as they move from nascence to maturity, and each of us must apply that concept to our own situation.

If one is an American and wants to be part of that growth and reap some of the rewards, speaking one of the languages spoken where that growth will happen is going to be a big a plus, if not a necessity. I got started working internationally that I didn't have to speak anything other than English. My kids, however, will have to fluently speak something in addition to English, be it Spanish, Hindi or Mandarin/Cantonese or some other language, perhaps Arabic.

Sidebar:

FWIW, my kids went with Spanish as their main "other" language because there are more Spanish speaking democracies than there are Chinese or Arabic speaking ones, but they also speak and write passable, if not fluent, Mandarin...just in case fortune finds them from that direction...if it does, they are prepared to take advantage of the opportunity if/when it arrives. That's not luck happening; it's making one's own "luck." It's preparing to be able to reach out and and grab hold of an opportunity that comes one's way, even when it doesn't fall directly into one's lap.

You see, anyone can do this:

If that's the limit of what a team's players can and will do, that team isn't going to the World Series.

The more prepared ones are prepared to and will do this -- which takes a far wider array of adroitness, will, verve and ability than does standing there and catching a ball that is headed right into one's uplifted glove -- if that's what it takes to achieve success:

It's not always solely about what one can or wants to do. It's about being prepared, given the "rules of the game," to do what one must to make it happen. Success -- economic, political, athletic, academic, etc. -- more often results from what one exerts oneself to the fullest extent to make happen than it does from waiting for someone else to make it happen for oneself. But, hey, one is free to wait on that "knight in shining armor" if one wants. For those folks, I hope he shows up. Far be it from me to insist one do otherwise.

End of sidebar.You see, anyone can do this:

If that's the limit of what a team's players can and will do, that team isn't going to the World Series.

The more prepared ones are prepared to and will do this -- which takes a far wider array of adroitness, will, verve and ability than does standing there and catching a ball that is headed right into one's uplifted glove -- if that's what it takes to achieve success:

It's not always solely about what one can or wants to do. It's about being prepared, given the "rules of the game," to do what one must to make it happen. Success -- economic, political, athletic, academic, etc. -- more often results from what one exerts oneself to the fullest extent to make happen than it does from waiting for someone else to make it happen for oneself. But, hey, one is free to wait on that "knight in shining armor" if one wants. For those folks, I hope he shows up. Far be it from me to insist one do otherwise.

The aforementioned illustrations aside, let's return more directly to why I wrote what's above and cited the other member's and my own remarks at the start of this post (Note: it's not to discuss whether anyone aims to educate folks here)....

Researchers, in a report prepared for the National Council on Economic Education, state that 34% of respondents scored an "A" or "B" on an economics quiz that at best represents the tip of the iceberg of what constitutes "the basics" of economics.

All the more surprising is that 50% of the respondents indicated they had studied economics. That is surprising because the nature of the questions is exceedingly simple; one would expect, given the simplicity of the questions and having studied econ, at least 50% of the adults in the survey to have scored an "A" or "B" on the quiz. In fact, most of the quiz questions ask about the handful of things that are accurately intuited about economic principles. In my and others' opinion, a lot about economics isn't intuitive at all; one has to actually study and think pretty carefully about most econ principles and concepts. (If you were a "curve buster" in an econ class, or endured the outcome of there being a two or three of them in your econ class, you know what I'm talking about.) The impact of free trade vs. constrained trade is one such thing. (If you click on the preceding link, you'll find a discussion of the theory (science sense of the word) of comparative advantage along with a very good depiction intended for skeptics of free trade's net benefits over restricted trade.)

That study linked above is just one that discusses the insufficiency manifest among Americans in general when it comes to economic topics. Given their dearth of basic economic awareness, just how do folks justifiably ascribe to ideas such as "the middle class have been defrauded by the elite?" (Power elite, intellectual elite, monied elite, insiders, etc.) By what means do they know? Because someone who is among one of the "elite" says so in an effort to garner the "non elite's" support?

The fact is that nobody has misled the American people. What has happened is that people have allowed themselves to believe for topics that it's all "really quite simple." Well, making sense of those topics and how to manage one's affairs re: them is pretty simple if one understands them, but clearly, for many topics, most particularly economics and science, most folks don't. Even worse, they don't bother to get well informed (even at a basic level) on the topic. And the terrible thing about that is that it's just not that hard to do for a wide variety of subject. The factual and objective information is there for the taking.

- Khan Academy

- Board of Governors of the Federal Reserve Bank

- Vox is a research-based policy analysis and commentary from leading economists

- Economic Research @ St. Louis Fed is a highly regarded economic research website.

- MIT world: the free videos from economics, business and finance professionals, from theoretical reasoning to practical experience.

- Google Scholar

- College Degree.com | When Wikipedia Won't Cut It: 25 Online Sources for Reliable, Researched Facts

- 6 Best Fact Checking Websites That Help You Distinguish Between Truth and Rumors

- TOP TEN LEGAL WEBSITES Starting Points - Appalachian School of ...

- American Association for the Advancement of Science

- Proceedings of the National Academy of Sciences (PNAS) of the USA

- ScienceStage.com

- ScienceDaily

- NOVA

- Public Library of Science (PLoS)

- Understanding Science

- Union of Concerned Scientists (UCS)

- Association for Computing Machinery (ACM) – The world’s largest educational and scientific computing society that delivers resources that advance computing as a science and a profession

- Institute of Electrical and Electronics Engineers (IEEE) – The world’s largest nonprofit, professional association dedicated to advancing technological innovation and excellence for the benefit of humanity

- National Association for Research in Science Teaching (NARST) – A worldwide organization of professionals committed to the improvement of science teaching and learning through research

- National Science Teachers Association (NSTA) – A member-driven organization committed to promoting excellence and innovation in science teaching and learning for all

- American Chemical Society (ACS) – A congressionally chartered independent membership organization which represents professionals at all degree levels and in all fields of chemistry and sciences that involve chemistry

- The American Institute of Physics (AIP) – A nonprofit, membership corporation created for the purpose of promoting the advancement and diffusion of the knowledge of physics and its application to human welfare

- National Earth Science Teachers Association (NESTA) – A nonprofit, educational organization whose purpose is the advancement, stimulation, extension, improvement, and coordination of Earth and Space Science education at all educational levels

- American Institute of Biological Sciences (AIBS) – A nonprofit, scientific association dedicated to advancing biological research and education for the welfare of society