Who in the fuck are the Republicans to give all of our manufacturing to other nations, then put us so deeply in debt that we will not be able to say no. You damned fools have been supporting the very people that would control us all. All you have to do is look at what happened to Britain when Eisenhower used their debt as leverage during the Suez Canal crisis to realize the situation that the Republicans have put us in.

The newest tax bill is exactly what I am talking about. Instead being fiscally responsible and addressing the deficit, letting all the tax cuts expire, President Obama, the Democrats and Republicans, are now borrowing even more. The 2% cut in SS makes no sense at all, except in the context of defunding the SS system prepatory to a takeover by the multinational bankers.

What we are seeing now is a choice between two parties, neither of which are showing any sense of urgency at all in addressing the fact that we are selling our independence as a nation. In the meantime, we have the Teabaggers and the like, doing all they can to speed the process.

Yeah and the Democrats had nothing to do with the hostile bussiness enviroment that forced them into that move.

Anyone who thinks higher taxes is a good idea is in a bracket that doesnt pay any.

And as far as im concerned they shouldnt be allowed to vote,if they dont put in any bucks into the system why should they have a say about how its spent?

It's pretty obvious how a person who doesnt pay any taxes is going to vote when it comes to legislation that gives them more free money.

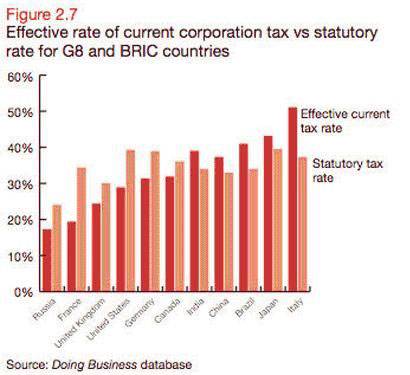

okay. I guess I took your point overall was speaking to the tax environment worldwide and the overall burden that makes it say more profitable for a co. to move to say India.....thats another debate encompassing the whole enchilada. There are variables like regulatory and environmental consideration that skew the the overall take away.

okay. I guess I took your point overall was speaking to the tax environment worldwide and the overall burden that makes it say more profitable for a co. to move to say India.....thats another debate encompassing the whole enchilada. There are variables like regulatory and environmental consideration that skew the the overall take away.