CultureCitizen

Silver Member

- Jun 1, 2013

- 1,932

- 140

- 95

- Thread starter

- #21

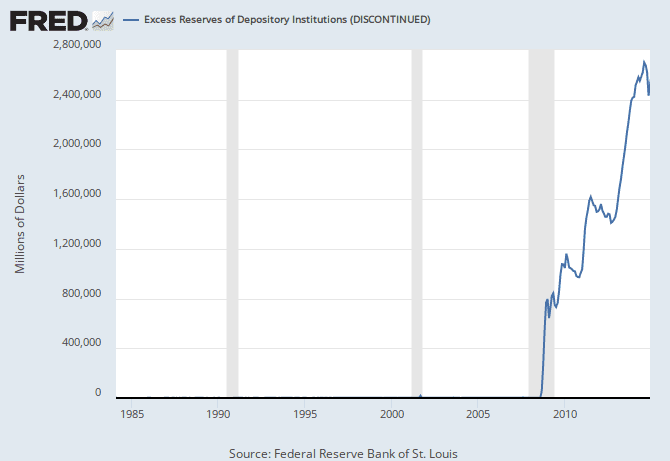

Yes, if you're going to claim that a few billion in potential losses is going to cause banks with TRILLIONS IN EXCESS RESERVES to become insolvent, your lack of backup information makes your claim opaque.

Trillions ? JPMorgan which is one of the big banks has only 163 Billions

JPMorgan Chase may need another 20 billion after Fed sets new rule - Fortune

Do you have any source to support your statement?

I'm not sure what is the exact leverage of oil companies, they've been sustaining losser for several years. Sure enough they have sufficient capital to withstand the oil prices at the current level for several quarters, but if this prices are maintained for mor than a year it could be catastrofic.