- Apr 12, 2011

- 3,814

- 758

- 130

As the economy continues to tank "unexpectedly," a new rationale has emerged: "Structural" problems are to blame, not policy errors - an idea as dangerous as it is foolish.

The most recent example of this kind of thinking comes from Mark Zandi, the widely quoted chief economist at Moody's Analytics and an adviser to President Obama on stimulus.

Speaking recently to columnist Robert Samuelson, Zandi estimated that "full employment" - the jobless rate below which inflation begins to rise - is now 6%. A few years ago, economists agreed it was 5% or less.

But what does 6% "full employment" mean? We've lost 6.9 million jobs from the peak, but if Zandi's right, with unemployment at 9.1%, we'll have serious inflation when we recoup just 4.8 million of those jobs. With 14 million looking for work, that's an alarming idea.

The problem is, this idea lets Washington off too easy.

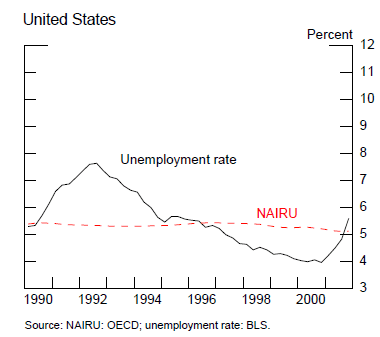

To begin with, "full employment" - what economists call the Non-accelerating Inflation Rate of Unemployment, or NAIRU - doesn't have a single, commonly agreed upon level. One economist thinks it's 6%, another 7%, another maybe 4.5%. It's a moving target.

What concerns us is that this will become the new normal. "Nothing can be done," goes the mantra, "it's a structural problem. We've done all we can." Well, the "structural problems" were actually caused by bad policies. Zandi, a Democrat, should know this. He wanted an even bigger stimulus than the one we got.

Stimulus didn't work, and we aren't creating enough jobs to bring the jobless rate down. Rather than changing their strategy, he and his colleagues now seem to tell us this is just how the economy is. Live with it.

Well, the real reason we have high unemployment is because of Washington's costly repeated mistakes, including $700 billion in TARP spending, a regulatory clampdown on banks and Wall Street, $830 billion in "stimulus" and $2 trillion in Fed money-printing.

Undo those mistakes, and the economy will get better, businesses will hire and that 6% "full employment" rate will magically shrink.

But not with more stimulus, that's for sure.

Zandi, you may recall, once estimated that every dollar spent in stimulus would create $1.50 in economic activity and lots of new jobs. Didn't happen. Output is $750 billion below where it would be if the economy had recovered normally. And the number of U.S. jobs is still 6.9 million below the peak in 2007.

Evidence from around the world suggests that "stimulus" shrinks economic activity by taking resources from productive uses in the private sector and putting them to use instead in the unproductive public sector.

So what can we do to end this structural impasse? Cut spending, for one. Our government now sucks up $1.5 trillion a year to fund its deficits - money that could be creating millions of new jobs in the private sector.

For another, costly regulations, new health care mandates and the possibility of much higher taxes have businesses feeling besieged. Stop the assault on profit makers and job creators and they'll hire again.

America's problems creating jobs aren't a result of structural shifts in the economy that no one could foresee. They're a result of bad policies, plain and simple.

This is an editorial from Investor's Business Daily and is available here.

The most recent example of this kind of thinking comes from Mark Zandi, the widely quoted chief economist at Moody's Analytics and an adviser to President Obama on stimulus.

Speaking recently to columnist Robert Samuelson, Zandi estimated that "full employment" - the jobless rate below which inflation begins to rise - is now 6%. A few years ago, economists agreed it was 5% or less.

But what does 6% "full employment" mean? We've lost 6.9 million jobs from the peak, but if Zandi's right, with unemployment at 9.1%, we'll have serious inflation when we recoup just 4.8 million of those jobs. With 14 million looking for work, that's an alarming idea.

The problem is, this idea lets Washington off too easy.

To begin with, "full employment" - what economists call the Non-accelerating Inflation Rate of Unemployment, or NAIRU - doesn't have a single, commonly agreed upon level. One economist thinks it's 6%, another 7%, another maybe 4.5%. It's a moving target.

What concerns us is that this will become the new normal. "Nothing can be done," goes the mantra, "it's a structural problem. We've done all we can." Well, the "structural problems" were actually caused by bad policies. Zandi, a Democrat, should know this. He wanted an even bigger stimulus than the one we got.

Stimulus didn't work, and we aren't creating enough jobs to bring the jobless rate down. Rather than changing their strategy, he and his colleagues now seem to tell us this is just how the economy is. Live with it.

Well, the real reason we have high unemployment is because of Washington's costly repeated mistakes, including $700 billion in TARP spending, a regulatory clampdown on banks and Wall Street, $830 billion in "stimulus" and $2 trillion in Fed money-printing.

Undo those mistakes, and the economy will get better, businesses will hire and that 6% "full employment" rate will magically shrink.

But not with more stimulus, that's for sure.

Zandi, you may recall, once estimated that every dollar spent in stimulus would create $1.50 in economic activity and lots of new jobs. Didn't happen. Output is $750 billion below where it would be if the economy had recovered normally. And the number of U.S. jobs is still 6.9 million below the peak in 2007.

Evidence from around the world suggests that "stimulus" shrinks economic activity by taking resources from productive uses in the private sector and putting them to use instead in the unproductive public sector.

So what can we do to end this structural impasse? Cut spending, for one. Our government now sucks up $1.5 trillion a year to fund its deficits - money that could be creating millions of new jobs in the private sector.

For another, costly regulations, new health care mandates and the possibility of much higher taxes have businesses feeling besieged. Stop the assault on profit makers and job creators and they'll hire again.

America's problems creating jobs aren't a result of structural shifts in the economy that no one could foresee. They're a result of bad policies, plain and simple.

This is an editorial from Investor's Business Daily and is available here.