Well, so far this OP has been wrong.

Energy and food prices are dropping not increasing. This is good for the US's consumer driven economy.

About the only thing that is hurting some is Wall Street. But considering that when Wall Street was on a roll, that roll didn't trickle down to the working class, which just happens to make up the largest segment of the consumer class. So the deflation we are going through is helping more Americans than were being helped by the Wall Street surges.

In a sense, the working class is finally getting a raise.

Falling Food and Gas Prices Stoke Consumer Confidence

http://www.nytimes.com/2014/12/13/b...as-prices-stoke-consumer-confidence.html?_r=0

Energy prices aren't dropping due to any type welfare program for the working class. OPEC's time to go away as a major player in the futures markets killing global economies along the way. Overdue. Of course with energy prices dropping, food delivery costs are coming down.

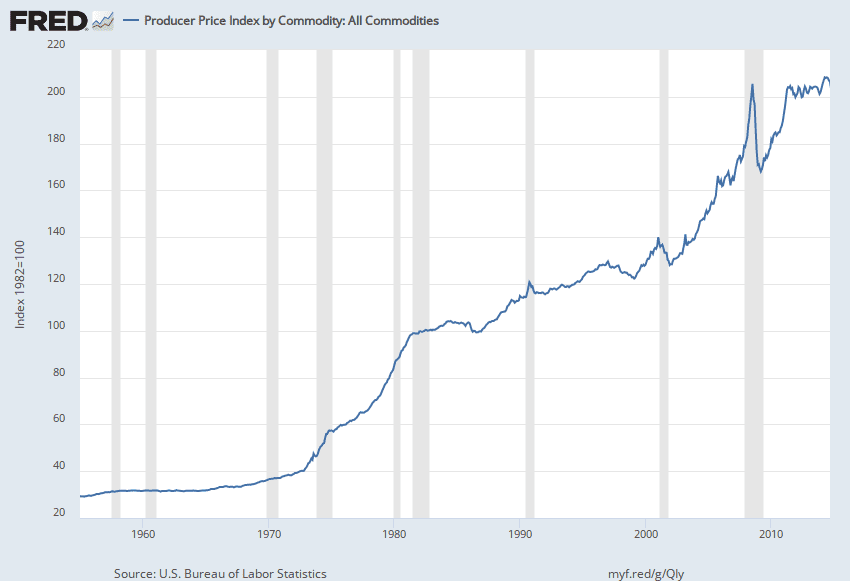

However, similar events happened this way in 2007.....look at Ivan, China. Global meltdown on the way ?

Energy prices are falling due to a glut in the marketplace. Everybody is pumping, and oil-burning machines are becoming more efficient.

Yes, a global meltdown is already underway. But I think the USA is actually sitting pretty. We've got a relatively low population, and relatively few environmental problems. We've got an opiated television/video game consuming population that will only go to a protest in order to take a selfie, so we have relatively little civil unrest. We've got the best farmland in the world. Our military and covert forces are hell-bent on thrashing our competition. Low energy prices and stagnated wages are actually spurring a manufacturing revival.

From a purely Machiavellian point of view, the USA is fairly well off, or at least stable. In a globalized economy, everything is relative.