- Dec 31, 2011

- 1,418

- 466

- 200

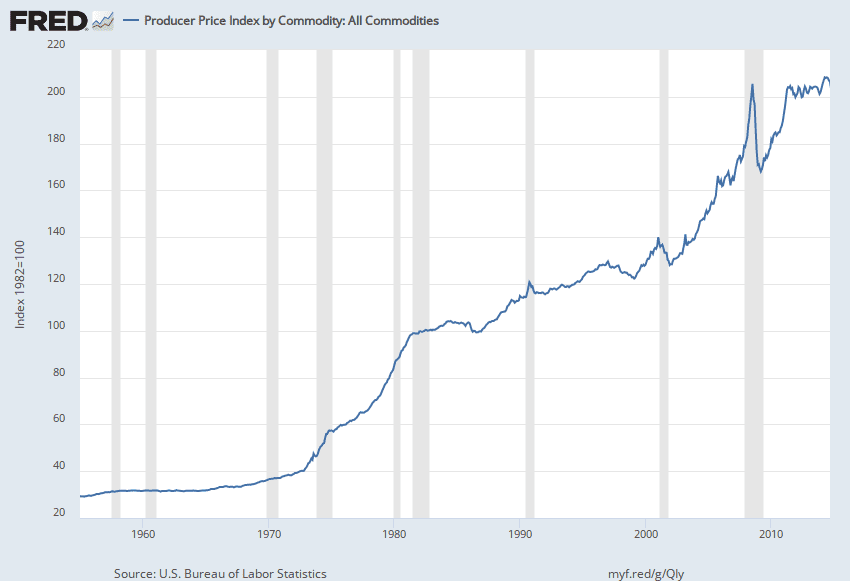

The use of Keynesian Economics causes inflation. The Brits found this out and abandoned this flawed economy theory. It has never worked.

When the Fed stops putting money ( it does not have ) into the economy, inflation will start and interest rates

will rise. Looks like we are going back to the Carter years.

Who is most effected by inflation, the Middle Class and Working Poor.

When the Fed stops putting money ( it does not have ) into the economy, inflation will start and interest rates

will rise. Looks like we are going back to the Carter years.

Who is most effected by inflation, the Middle Class and Working Poor.