Trajan

conscientia mille testes

so, if the CBO is correct, the issue it NOT revenue, its SPENDING...most of us knew that but its always nice to see it spelled out.

In effect they want to spin the evil rich as misers unwilling to pay more, to cover for adding what amounts to another stimulus to every years' outlays....of course we don't have a formal budget as they have not created one for over 4 years, rolling along on Continuing Resolutions which has been the plan all along as they enshrine this spending level,as we don't get an accounting until now, the end of the federal fiscal year reflecting just what we have borrowed/spent for the year.

November 11, 2012, 6:16 p.m. ET

The Hard Fiscal Facts

Individual tax payments are up 26% in the last two years.

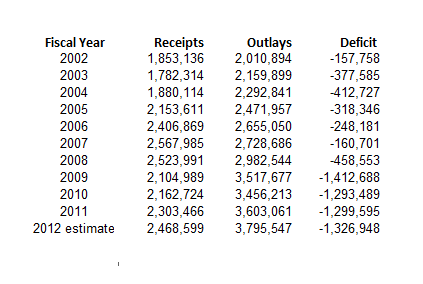

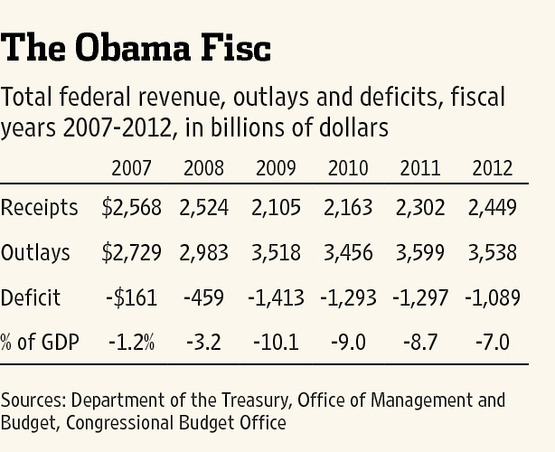

The nearby table lays out the ugly details. The feds rolled up another $1.1 trillion deficit for the year that ended September 30, which was the biggest deficit since World War II, except for each of the previous three years. President Obama can now proudly claim the four largest deficits in modern history. As a share of GDP, the deficit fell to 7% last year, which was still above any single year of the Reagan Presidency, or any other year since Truman worked in the Oval Office.

Tax revenue kept climbing, up 6.4% for the year overall, and at $2.45 trillion it is now close to the historic high it reached in fiscal 2007 before the recession hit. Mr. Obama won't want you to know this, but this revenue increase is occurring under the Bush tax rates that he so desperately wants to raise in the name of getting what he says is merely "a little more in taxes." Individual income tax payments are now up $233 billion over the last two years, or 26%.

snip-

This healthy revenue increase comes despite measly economic growth of between 1% and 2%. Imagine the gusher of revenue the feds could get if government got out of the way and let the economy grow faster.

Now let's look at outlays, which declined a bit in 2012. That small miracle was achieved thanks to a 4% fall in defense spending, a 24% fall in jobless benefits, and an 8.9% decline in Medicaid spending.

Note, however, that federal spending remains at a new plateau of about $3.54 trillion, or some $800 billion more than the last pre-recession year of 2007. One way to think about this is that most of the $830 billion stimulus of 2009 has now become part of the federal budget baseline. The "emergency" spending of the stimulus has now become permanent, as we predicted it would.

more at

Review & Outlook: The Hard Fiscal Facts - WSJ.com

In effect they want to spin the evil rich as misers unwilling to pay more, to cover for adding what amounts to another stimulus to every years' outlays....of course we don't have a formal budget as they have not created one for over 4 years, rolling along on Continuing Resolutions which has been the plan all along as they enshrine this spending level,as we don't get an accounting until now, the end of the federal fiscal year reflecting just what we have borrowed/spent for the year.

November 11, 2012, 6:16 p.m. ET

The Hard Fiscal Facts

Individual tax payments are up 26% in the last two years.

The nearby table lays out the ugly details. The feds rolled up another $1.1 trillion deficit for the year that ended September 30, which was the biggest deficit since World War II, except for each of the previous three years. President Obama can now proudly claim the four largest deficits in modern history. As a share of GDP, the deficit fell to 7% last year, which was still above any single year of the Reagan Presidency, or any other year since Truman worked in the Oval Office.

Tax revenue kept climbing, up 6.4% for the year overall, and at $2.45 trillion it is now close to the historic high it reached in fiscal 2007 before the recession hit. Mr. Obama won't want you to know this, but this revenue increase is occurring under the Bush tax rates that he so desperately wants to raise in the name of getting what he says is merely "a little more in taxes." Individual income tax payments are now up $233 billion over the last two years, or 26%.

snip-

This healthy revenue increase comes despite measly economic growth of between 1% and 2%. Imagine the gusher of revenue the feds could get if government got out of the way and let the economy grow faster.

Now let's look at outlays, which declined a bit in 2012. That small miracle was achieved thanks to a 4% fall in defense spending, a 24% fall in jobless benefits, and an 8.9% decline in Medicaid spending.

Note, however, that federal spending remains at a new plateau of about $3.54 trillion, or some $800 billion more than the last pre-recession year of 2007. One way to think about this is that most of the $830 billion stimulus of 2009 has now become part of the federal budget baseline. The "emergency" spending of the stimulus has now become permanent, as we predicted it would.

more at

Review & Outlook: The Hard Fiscal Facts - WSJ.com

are you questioning the veracity of that data?

are you questioning the veracity of that data?