jodylee

Active Member

- Jan 26, 2007

- 405

- 65

- 28

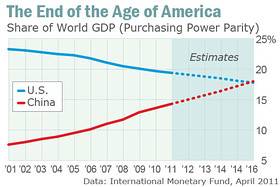

America's economic dominance on the world stage could end in five years, according to a new report.

The International Monetary Fund's latest forecast predicts that China's economy will outflank the United States' in 2016.

IMF Predicts Chinese Economy to Surpass U.S. in 2016 - FoxNews.com

The International Monetary Fund's latest forecast predicts that China's economy will outflank the United States' in 2016.

IMF Predicts Chinese Economy to Surpass U.S. in 2016 - FoxNews.com