- Sep 19, 2011

- 28,369

- 9,954

- 900

Is 22% more then 14%?

Is $123,477 MORE then $5,736 by 2,152%?

I really would like ALL of you to honestly tell me that is NOT TRUE if it isn't!

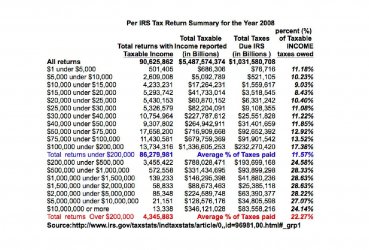

Because THE FACTS as presented by the IRS in 2008 of the 90 million tax returns

PROVE Obama is a f...ing LIAR!!!

1) 86 million tax returns in 2008 paid 14% of their TAXABLE income in TAXES PAID!

2) 4.3 million returns paid: 22% of their taxable income in taxes!

3) These 4.3 million returns PAID an average of $123,477

4) The 86 million returns paid an average of $5,736

5) THE 4.3 million PAID 2,152% MORE then the 86 million average return!

Is $123,477 MORE then $5,736 by 2,152%?

I really would like ALL of you to honestly tell me that is NOT TRUE if it isn't!

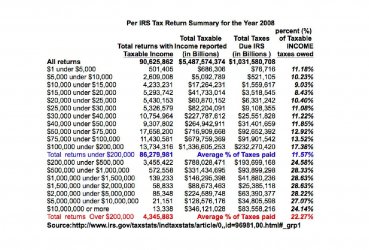

Because THE FACTS as presented by the IRS in 2008 of the 90 million tax returns

PROVE Obama is a f...ing LIAR!!!

1) 86 million tax returns in 2008 paid 14% of their TAXABLE income in TAXES PAID!

2) 4.3 million returns paid: 22% of their taxable income in taxes!

3) These 4.3 million returns PAID an average of $123,477

4) The 86 million returns paid an average of $5,736

5) THE 4.3 million PAID 2,152% MORE then the 86 million average return!