Dad2three

Gold Member

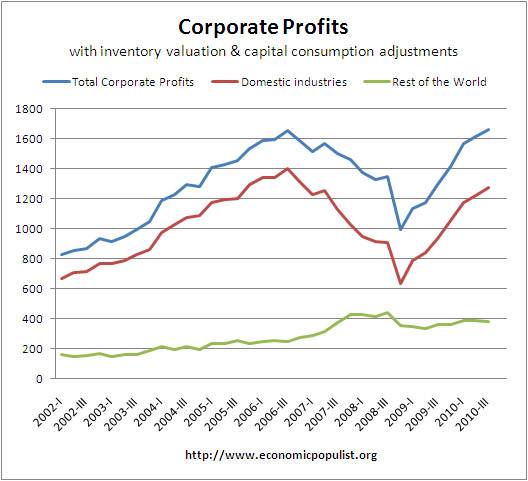

Why would Corps who make 90%+ of the Corp profits IN THE USA need to HQ offshore,

90%????The company said: ‘Cisco pays all taxes that are due. The cash held in Cisco’s non-US subsidiaries is generated from Cisco’s international operations. Cisco has approximately 50% of its employees outside the US and Cisco’s sales are approximately 50% from non-US customers.

One company? Well dam,n that proves it, lol