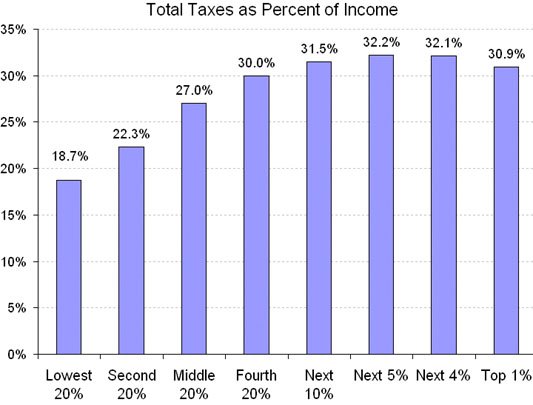

The research from Citizens for Tax Justice a liberal organization that advocates fair taxes for middle- and low-income families uses 2008 data for all federal, state and local taxes combined. It found that the average effective tax rate is 29.8 percent, and that including state and local taxes makes the tax curve look much less steep:

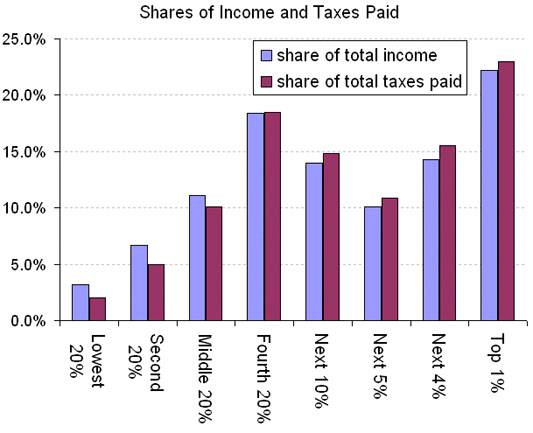

The group also finds that in 2008 the share of total federal, state and local taxes paid by each income group was relatively close to the share of income that that group brings in, at least as compared to comparable 2006 numbers for effective federal tax rates:

Just How Progressive Is the Tax System? - Economix Blog - NYTimes.com