edthecynic

Censored for Cynicism

- Oct 20, 2008

- 43,044

- 6,883

- 1,830

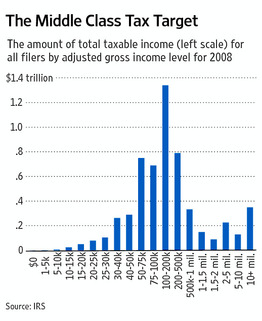

That part gets my vote!!!!Your link had this sub link, "However, recently released statistics from the Internal Revenue Service" which is where I found that amount in column 54.

Thanks. I clicked that before but did not realize all the info scrolling to the right.

It is an eye opener. Looking at the change in "Tax as a percentage of AGI" from 2001 to 2007 the largest percentage drop is in the highest income earners. They did recover some in 2008 & 2009. I guess the Rich really did get a bigger percent tax break.

Which means we need to overhaul our tax code or go to a flat tax with no deductions, loopholes, or credits. Or at least put a ceiling on deductions and clamp down on the req'ts for tax exempt foundations.