- Apr 12, 2011

- 3,814

- 758

- 130

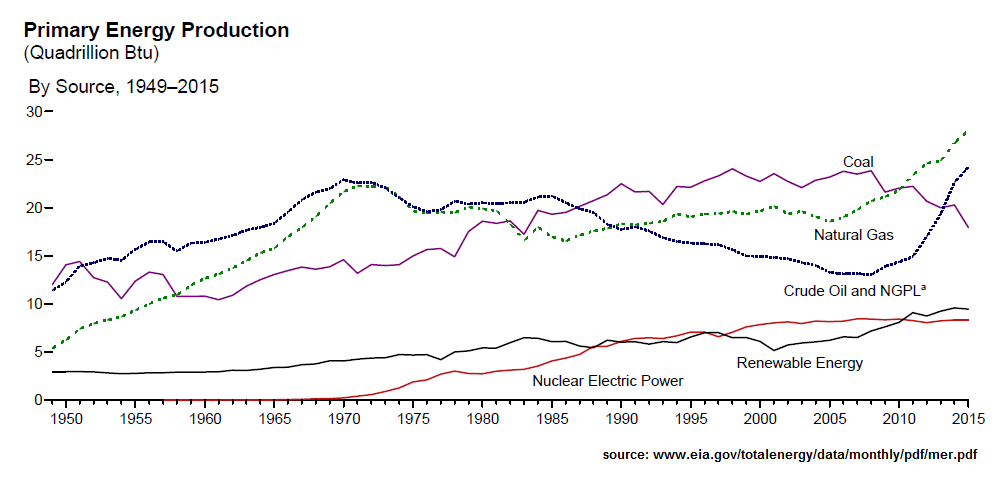

That's so easy to say but we all know why nobody drives a wind powered car to work. We can say what we want about how this or that is so good that we need to force others to buy it, but the fact remains after decades and billions in forced tax subsidies--Wind And Solar Are Our Cheapest Electricity Sources

--the so-called 'renewables' are just not worth it.