Slade3200

Diamond Member

- Jan 13, 2016

- 65,291

- 16,439

- 2,190

I have nothing against reducing deficits and the national debt, but the timing has to make sense. With interest rates as low as they are and our economy still in need of growth it is a smart move to simulate the economy with smart investments. Infrastructure and education would be a good focus. Once we see more growth in GDP and a hike in interest rates we can switch gears to a more conservative agenda, I just don't believe it is the right time.What would it take to make the dollar worthless?The US owns the treasury, it can't default. The more concerning issue would be a market crash caused by massive loan defaults in the private sector like what happened in 2008.

Yes it can default when it can no longer pay its debts with money that has any value.

When our credit rating continues to deteriorate--remember that we lost our sterling AAA rating after Obamas first spending spree that sent the deficits soaring--and our creditors, both domestic and foreign start losing money because the value of the bonds they hold deteriorate in value because our money becomes less and less trustworthy and therefore it is of less and less value. The collapse won't happen overnight, but it is simply impossible to run anything on credit indefinitely when there is no feasible way to repay what is borrowed.

Fallacy of Composition

Over Simplification

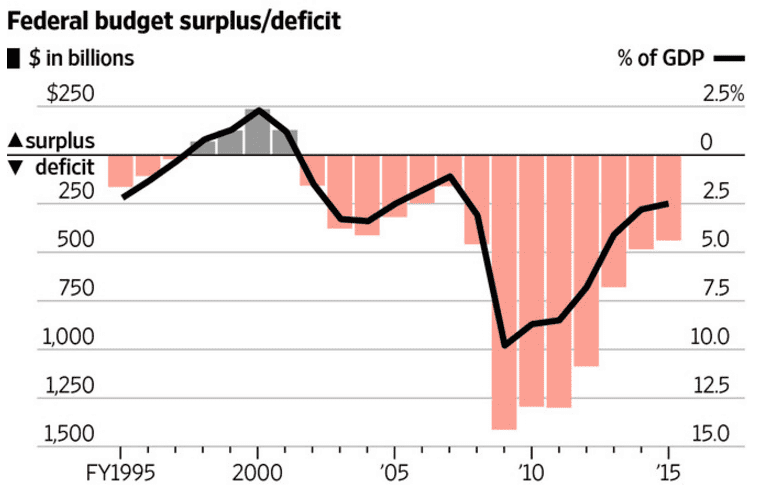

You seem to be placing all your eggs in one basket, that of the federal budget deficit, which, as Moody's notes below, has been "declining steeply." Even if one characterizes the spending in the early years of Mr. Obama's Presidency as "spending sprees," that so-called spree has ebbed.

- Moody's credit rating of the USA -- AAA, as of 2015 -- The rating was supported by factors including a strong record of gross domestic product growth and the status of the U.S. dollar and Treasuries as the global reserve currency and bond market benchmark.

- From September 2014:

"Supporting the Aaa rating are the very large and diverse economy, a strong record of GDP and productivity growth, and the status of the dollar and the Treasury bond as global reserve currency assets, allowing the US government to carry a higher level of debt relative to other countries

With budget deficits declining steeply in recent years, debt ratios are stabilizing and should remain at or near current levels over the remainder of the decade. The outlooks for near-term economic and fiscal performance are also favorable.

Although debt levels in relation to GDP are likely to remain close to flat, they are also relatively high. After doubling from 35.1% of GDP in 2007 to 72.0% in 2013, the ratio of federal government debt to GDP is projected to peak at the end of 2014 at 74.4% and to stabilize at just below that level for the remainder of the decade. These high levels give the US government less flexibility to respond should it face another financial shock."Blue:

- Fitch's credit rating of the USA -- AAA, as of 2015 -- "The U.S.’ AAA rating is underpinned by the sovereign’s unparalleled financing flexibility as the issuers of the world’s pre-eminent reserve currency."

- S&P's credit rating of the USA -- AA+, as of 2011 (which is when S&P downgraded it from Aaa -- "The U.S. is on better footing, that the deficit situation has been reduced over the last year and that the amount of the money the Treasury borrows has declined. Ultimately the fundamental fiscal situation in the U.S. has improved and the credit quality of the U.S. is in very good shape right now."

That's so for individuals, non-profits, and companies. It's not so for governments like the U.S.

I'm not suggesting that governments can just spend "willy nilly." I'm saying that the debt we carry as a nation is within our means. With AAA and AA+ ratings, the three ratings agencies seem to feel that way too. Who are you or I to disagree? I know I sure haven't audited the U.S.' to find out the details behind all its financing arrangements, income streams, and spending requirements. I know only what I come by in the news or look for, and I know that is an incomplete story, even when it isn't biased by partisanship.

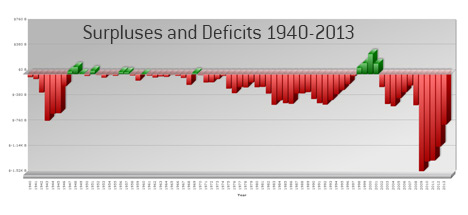

Reducing deficits from the astronomical heights of 2009 and 2010 but deficits remaining well above historical highs of previous administrations bears some scrutiny don't you think?

From your cited article printed in June, 2014, 22 months ago:

. . .In 2011, when S&P stripped America of its top grade, it cited political wrangling about the debt limit and the lack of a plan to reduce deficits. . .

The national debt June, 2014, was $17, 685 billion + and counting.

The national debt now is $19, 200 billion + and counting even faster. That is more than 1.5 trillion dollar increase due to deficits. The guy on the buy gold ad this morning said we are adding more than $4 billion a day to the debt. Even the most left leaning economists agree that deficits will shoot up soon after Obama leaves office due to fiscal policy including Obamacare among others.

CBO Warns Federal Budget Deficit will Increase in 2016 - 2016 - Washington Highlights - Government Affairs - AAMC

So where is the plan to reduce the deficits? I'm not seeing them.