hvactec

VIP Member

Boston Properties CEO Mort Zuckerman on the GDP and the outlook for the economy.

video Has The Economy Finally Turned the Corner?

video Has The Economy Finally Turned the Corner?

Last edited:

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

A spate of data Thursday showed U.S. factories grew last month at the fastest pace since June, construction spending increased for a third straight month, and both retail sales and auto sales rose in November. But the number of people applying for unemployment benefits is still too high to signal strong hiring. The reports offered a mixed picture for the economy one day before the government reports on job growth in November. Economists project that employers added a net 125,000 jobs. That's not enough to lower the unemployment rate, which is projected to stay at 9 percent for the second straight month. And manufacturers could face strains overseas in key export markets, especially if Europe's debt crisis worsens and leads the continent into another recession.

For now, factories are growing. The Institute for Supply Management, a trade group of purchasing managers, said Thursday that its manufacturing index rose to 52.7 in November, up from 50.8 in October. Any reading above 50 indicates expansion. Factories have grown for 28 straight months. Bradley Holcomb, chair of the ISM's survey committee, said manufacturers "are cautiously more optimistic about the next few months based on lower raw materials pricing and favorable levels of new orders." Still, companies have tempered their outlook with concerns about future economic growth, government regulation and the debt crisis in Europe, he added.

New orders rose to a seven-month high and production increased, according to separate indexes in the report. Ian Shepherdson, an economist at High Frequency Economics, said the gains suggest factory output will expand at an even faster pace next month. "The economy seems finally to be developing real momentum; growth is accelerating," he said in a note to clients. But a measure of factory employment fell. The drop indicates manufacturers are still hiring, but at a slower pace than the previous month. "Manufacturers are trying to meet demand without significantly increasing their work force," said Ryan Wang, an economist at HSBC Securities.

Worker productivity rose in the July-September quarter by the most in 18 months, while labor costs fell, the government said Wednesday. A more productive and less-costly work force can boost corporate profits. But unless companies see more demand, they're unlikely to step up hiring. And manufacturers could soon see less demand overseas. Most economists expect Europe's financial crisis to tip that region into recession next year. About 20 percent of U.S. exports are shipped to Europe. China, the world's second-largest economy, is also slowing. Manufacturing in China contracted in November for the first time in nearly three years, according to business surveys released Thursday.

More Economy improving but job growth still weak - Yahoo! News

No they don't. GDP is when business sales pick up, and when that happens business start to hire.Most people aren't that concerned with GDP growth right now, the only thing most people are looking at is jobs. I understand the two usually go hand in hand...

What's the unemployment rate?

Uh, say what?Employment improved, but Unemployment dropped by more.

Uh, say what?Employment improved, but Unemployment dropped by more.

In a television interview to be broadcast on Sunday, Obama said the structural problems in the economy have been building for two decades and that repairing them would take more than one term in office and "probably take more than one president." He described himself as "the captain of a ship going through really bad storms." Excerpts of the interview were released by the network before its airing.

The U.S. economy has recently showed signs of improvement with the unemployment rate dropping from nine percent to 8.6 percent but it remains far above a normal traditional rate of four or five percent. The jobless rate is seen as a major factor in whether Mr. Obama can win re-election to another four-year term next November.

The president once again called on Congress to approve his nominee, Richard Cordray, to head a new consumer protection agency. In the interview he repeated comments made Saturday during his weekly address that Americans need an advocate against "dishonest businesses" and their "unscrupulous practices."

Source

Untrue. Receipt or benefits of eligibility are not and have never been a factor for calculating unemployment.We'll only count the people that are not getting benefits when it accelerates our cause.

Not quite. There's a difference between jobs and employment. + 120,000 jobs excludes agriculture, the self employed and some others, and counts multiple job holders for every job they have. Employment, as used to calculate the UE rate, counts everyone 16+ (except military and prisoners) and was +278,000 in November.The Labor Department said Friday that employers added 120,000 jobs last month. With that, the unemployment rate dropped to the lowest level in more than two and a half years.

For any purposes. The definition of Unemployed is without work and looking for work. If you're not working and not looking for work, you're not in the Labor Force...you're not available labor. And it's not just "stopped looking" it could also be "lost/left job and haven't started looking yet or don't intend on getting another job." And then there are those who left the population altogether through death, going to jail or mental institute, joining the military or emigrating. We can look at the Labor Force Flows to see what the gross changes were to give the net changes.But a key reason for the sharp drop was that about 315,000 people had stopped looking for work -- for the Labor Department's purposes, they were not counted as unemployed.

The prediction was contained in a report called "Situation and Prospects of the World Economy", drawn up by the UN Conference for Trade and Development and published by the United Nations. The document predicts that the world's Gross Domestic Product (GDP) will grow 2.6 percent in 2012 and 3.2 percent in 2013, if a relatively optimistic group of conditions are finally fulfilled.

However, if the employment crisis, the public debt problems and the fragility of the financial sector in Europe and the United States persist, then the prediction will be reduced to 0.5 percent in 2012, the document warned. The report also said that adversity in many developed economies is the most important cause of the world deceleration, and mentioned the example of the United States, a country where the GDP decreased in 2011, and it will go down further in 2012. The developing countries and economies in transition should register an increase of 5.4 percent in 2012 and 5.8 percent in 2013, with China and India on the lead.

However, the report refers to a slowdown of the Chinese economy: from 10.3 percent in 2010 to 9.3 in 2011, and prospects to shrink to 9 percent in 2012 and 2013. In the case of India, the planned growth will be 7.7-7.9 in 2012-2013, compared to 8.5 in 2010. The report estimates that the persistence of a high unemployment rate is still the weak point in economic recuperation in the developed countries. Finally, the document placed the job deficit in 2011 at 64 million and warned about a possible increase to 71 million in 2013.

Source

Steen Jakobsen, chief economist at Saxo Bank, said: Our common theme for this quarter is a Perfect Storm. Pressures in the Eurozone, public sector austerity and social tensions will all conspire to create the storm, in which no nation will be left untouched. Jakobsen will be visiting Dubai to discuss with financial media and professional investors of Saxo Bank (Dubai), a wholly owned subsidiary of Saxo Bank, the current market status in light of the recent crisis and the banks outlook for the first quarter of 2012.

Saxo Banks quarterly outlook takes a deeper look at what 2012 holds for various asset classes including foreign exchange, commodities and equities and the state of the macro economy and how it will be impacted by policy amendments, monetary policy and the current market turmoil. He believes 2012 could be the most pivotal year by far since the global financial crisis of 2008 and notes that the Middle East and North Africa (Mena) enjoyed good underlying fundamentals, but faced almost imperfect visibility on geopolitical risk.

Jakobsen said: We feel confident that Mena will stand stronger on both accounts at the end of 2012 but first we may need to go through a period of increased volatility. This leads us to a very defensive investment outlook not from a fear of the future rather from a high probability of seeing better entry levels during the course of the year. Jakobsen, a regular guest host and commentator on CNBC, Bloomberg and other networks, has more than 20 years of experience within the fields of proprietary trading and alternative investment.

World economy faces a 'perfect storm'

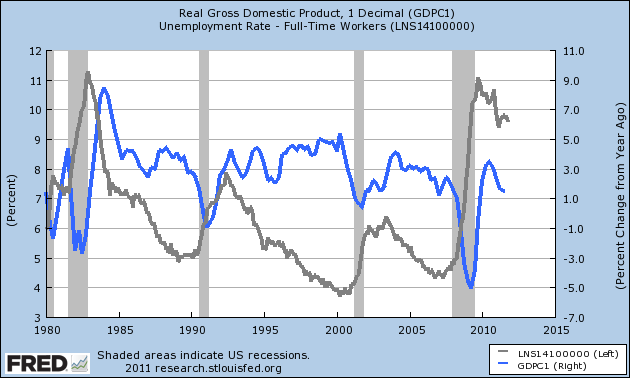

Huh. Just looked again at unemployment and gdp above. Now that GDP is falling again and unemployment rising, it looks like the economy is definitely turning the corner and we're going back into another recession.