Fact: Greeks lie, live in a dysfunctional country, and tax avoidance is a national sport.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Greeks Go Full Retard.

- Thread starter The Rabbi

- Start date

Fact: Greece has been in default for 108 years since 1800.

It is not fact, you are making things up. You are a liar. plain and simple. The facts show otherwise.

Fact: Greece has been in default for 108 years since 1800. Source - Reinhardt and Rogoff: This Time is Different.

Fact: The only way Greece can stay in the eurozone is if there is a wealth transfer from the northern countries to the less productive Greeks. That's why they are so much in debt.

Fact: Greece has no business sharing the same currency as Germany.

montelatici

Gold Member

- Feb 5, 2014

- 18,686

- 2,104

- 280

Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

montelatici

Gold Member

- Feb 5, 2014

- 18,686

- 2,104

- 280

Nazi forced loans

"The Greek government has demanded that Germany pays it back€279bn (£205bn) in loans Greece was forced to give the Nazi authorities who occupied the country during World War Two...

In December 1942 Greece was forced by Nazi authorities to loan German 476m Richsmarks to cover the cost of the German occupation, which it says it has never been paid back.

€279bn is 125 per cent of Greece’s €223bn GDP; the money is around a tenth of Germany’s GDP.

Greece wants Germany to repay 279bn it was forced to loan the Nazi authorities during WWII - Europe - World - The Independent

"The Greek government has demanded that Germany pays it back€279bn (£205bn) in loans Greece was forced to give the Nazi authorities who occupied the country during World War Two...

In December 1942 Greece was forced by Nazi authorities to loan German 476m Richsmarks to cover the cost of the German occupation, which it says it has never been paid back.

€279bn is 125 per cent of Greece’s €223bn GDP; the money is around a tenth of Germany’s GDP.

Greece wants Germany to repay 279bn it was forced to loan the Nazi authorities during WWII - Europe - World - The Independent

Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

montelatici

Gold Member

- Feb 5, 2014

- 18,686

- 2,104

- 280

Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

- Aug 27, 2008

- 18,450

- 1,823

- 205

Toro is probably the most knowledgable person on this board, especially when it comes to economics. So this is extremely funny.Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

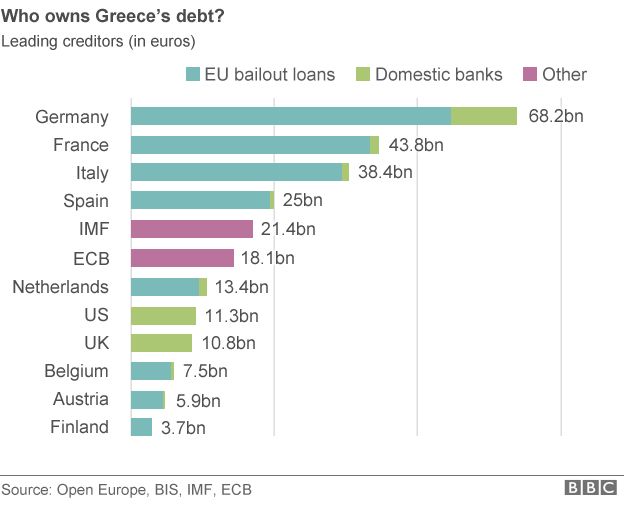

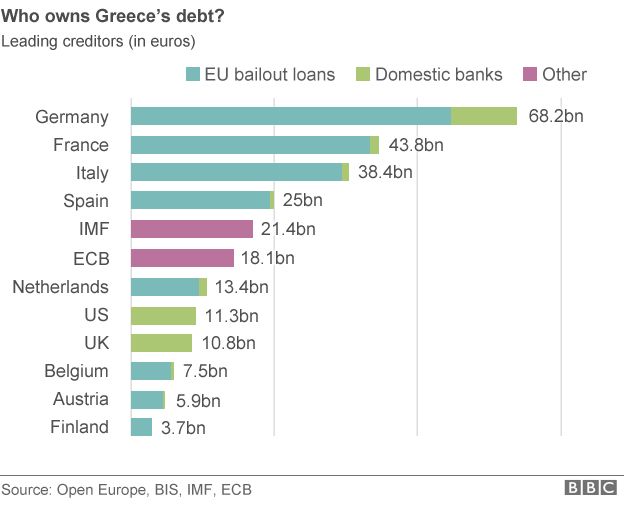

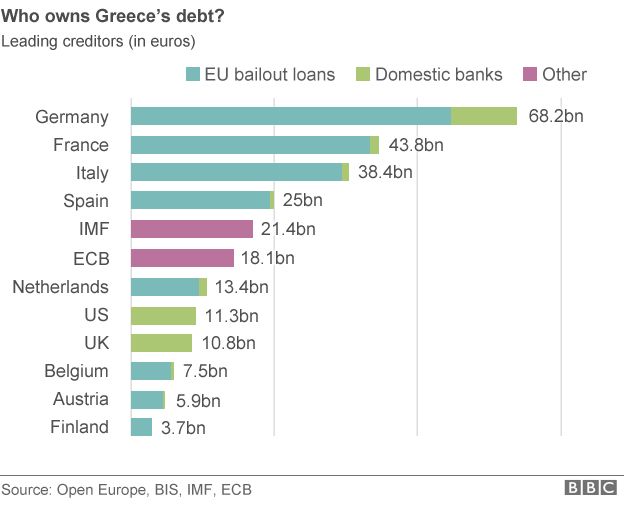

You promote the loony left position that "poor Greece" is the victim of German greed while conveniently ignoring the fact that no one forced Greece into her current plight. Germany holds about 1/3 of Greece's foreign debt and many of the other creditor nations - Spain, Italy and even France - have serious financial problems of their own. Blaming Germany may seem a viable loony leftist strategy but not to anyone even remotely knowledgeable about global economics.

montelatici

Gold Member

- Feb 5, 2014

- 18,686

- 2,104

- 280

Toro is probably the most knowledgable person on this board, especially when it comes to economics. So this is extremely funny.Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

Yeah right. The guy is an idiot. Hasn't a clue about economics.

montelatici

Gold Member

- Feb 5, 2014

- 18,686

- 2,104

- 280

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

You promote the loony left position that "poor Greece" is the victim of German greed while conveniently ignoring the fact that no one forced Greece into her current plight. Germany holds about 1/3 of Greece's foreign debt and many of the other creditor nations - Spain, Italy and even France - have serious financial problems of their own. Blaming Germany may seem a viable loony leftist strategy but not to anyone even remotely knowledgeable about global economics.

What does that have to do with the fact that Germany is a pathological defaulter and that the Nazis forced Greece to provide Germany loans that Germany never paid back. Come on you frigging moron, tell me what that frigging graph has to do with it.

- Aug 27, 2008

- 18,450

- 1,823

- 205

Your contribution to this thread has been to whine about Nazis, which is irrelevant to Greece's situation in 2015. Who's an idiot?Toro is probably the most knowledgable person on this board, especially when it comes to economics. So this is extremely funny.Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

Yeah right. The guy is an idiot. Hasn't a clue about economics.

montelatici

Gold Member

- Feb 5, 2014

- 18,686

- 2,104

- 280

Your contribution to this thread has been to whine about Nazis, which is irrelevant to Greece's situation in 2015. Who's an idiot?Toro is probably the most knowledgable person on this board, especially when it comes to economics. So this is extremely funny.Sorry, you are not a liar, I apologize. Your sources are liars.

"NO, ROGOFF AND REINHART, THIS TIME IS DIFFERENT! SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

But it was all a lie. Yes, a lie. They screwed up their data analysis. Like so many times before—think Larry Summers at Harvard, Chicago’s Gene Fama, or Charles Plosser at the University of Rochester—the economists reach results counter to intuition and the real world. ....

We noticed that their data just did not add up. Leave to the side the silliness of simply aggregating across 8 centuries of experience, and adding up debt ratios of countries as disparate as the USA today or, say, Greece in 1932, let alone some feudal state operating on a gold standard a couple of hundred years ago. As I’ve remarked, any real historian would find the methodology ludicrous.

More importantly, they have no idea what sovereign debt is. They add together government debts issued by states on gold standards, fixed exchange rates and floating rates. They aggregated across governments that issue debt in their own currency and states that issue debt denominated in foreign currency. It is not even possible to determine from their book exactly what is government debt versus private debt.

- See more at: EconoMonitor Great Leap Forward NO ROGOFF AND REINHART THIS TIME IS DIFFERENT SLOPPY RESEARCH AND NO UNDERSTANDING OF SOVEREIGN CURRENCY

Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

Yeah right. The guy is an idiot. Hasn't a clue about economics.

Oh I see, Nazis occupying Greece and forcing loans from their treasury that were never paid back has nothing to do to the Greek lack of funds today. You are the idiot.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

You promote the loony left position that "poor Greece" is the victim of German greed while conveniently ignoring the fact that no one forced Greece into her current plight. Germany holds about 1/3 of Greece's foreign debt and many of the other creditor nations - Spain, Italy and even France - have serious financial problems of their own. Blaming Germany may seem a viable loony leftist strategy but not to anyone even remotely knowledgeable about global economics.

What does that have to do with the fact that Germany is a pathological defaulter and that the Nazis forced Greece to provide Germany loans that Germany never paid back. Come on you frigging moron, tell me what that frigging graph has to do with it.

What does your anti-German whining have to do with a thread entitled "Greeks Go Full Retard" Moron? As always you have things upside-down, inside-out, and backwards. That friggin' graph tells any knowledgeable observer that other countries - some of whom can't afford Greece's shameful irresponsibility (and none of whom should have to) - came to Greece's aid when needed and are being rewarded with the loony leftist idea that Greece is the victim here and not the perp.

- Aug 27, 2008

- 18,450

- 1,823

- 205

What year did this occur? What year is it right now?Your contribution to this thread has been to whine about Nazis, which is irrelevant to Greece's situation in 2015. Who's an idiot?Toro is probably the most knowledgable person on this board, especially when it comes to economics. So this is extremely funny.Clearly, you don't know what you're talking about, and you are desperately googling for something to save face in this Incredibly Important Internet Message Board

The criticism of R&R isn't that they are wrong about whether or not a country is in default. The criticism is their conclusion that a certain level of debt to GDP leads to financial crisis.

Try again, s0n.

No, I just posted fact. And, I have forgotten more than you will ever learn about economics.

Yeah right. The guy is an idiot. Hasn't a clue about economics.

Oh I see, Nazis occupying Greece and forcing loans from their treasury that were never paid back has nothing to do to the Greek lack of funds today. You are the idiot.

Similar threads

- Replies

- 133

- Views

- 15K

Latest Discussions

- Replies

- 101

- Views

- 297

- Replies

- 2K

- Views

- 31K

Forum List

-

-

-

-

-

Political Satire 8013

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 466

-

-

-

-

-

-

-

-

-

-