SniperFire

Senior Member

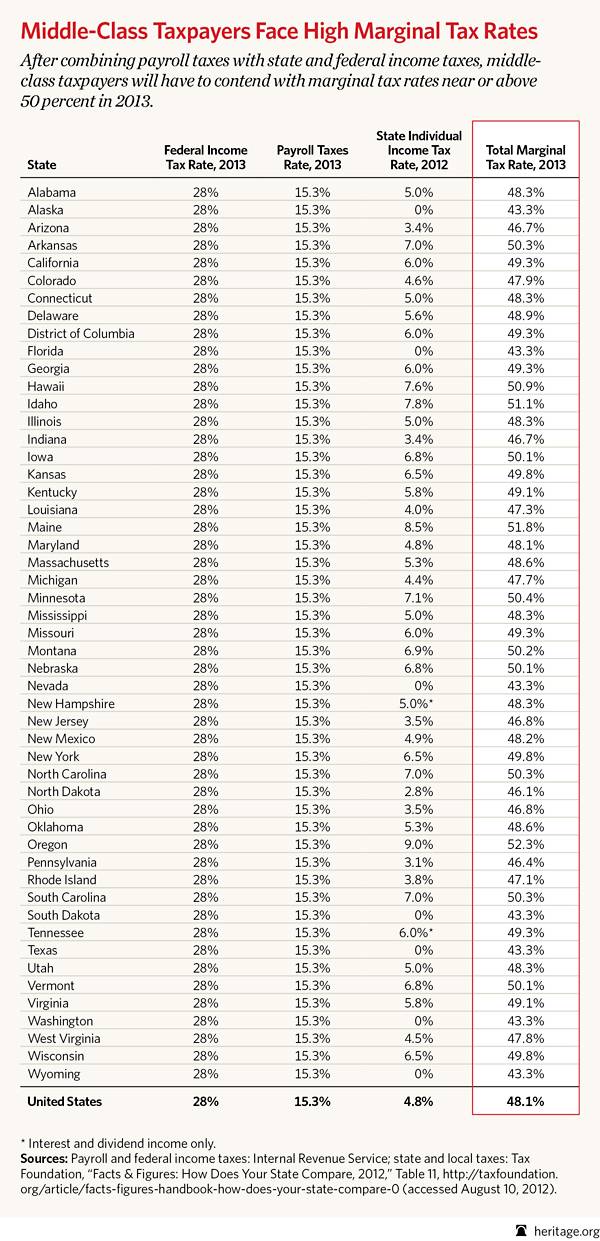

Entitlements consume every penny of taxes received in short order:

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

The rates you posted are lies for the average person. A 28% effective tax rate for federal income taxes is for the highest income earners.

I fucked up too. I paid 37% of my income to federal/state/city taxes alone. Sorry about that.

Now lets add in the payroll tax of 7.65%

I'm now paying 44.65% and i haven't even bought anything yet.

Indeed it is!

Perhaps I can direct your attention to the image that the OP posted:

Strange, it seems to mention something.. Something about Federal, Local taxes combined.

See, I just proved the relevance of my post.

The rates you posted are lies for the average person. A 28% effective tax rate for federal income taxes is for the highest income earners.

No, it is not. The brackets are as follows.:

Tax Rate Single Married, Filing Jointly Married, Filing Separately Head of Household

10% $0 $8,700 $0 $17,400 $0 $8,700 $0 $12,400

15% $8,700 $35,350 $17,400 $70,700 $8,700 $35,350 $12,400 $47,350

25% $35,350 $85,650 $70,700 $142,700 $35,350 $71,350 $47,350 - $122,300

28% $85,650 $178,650 $142,700 217,450 $71,350 $108,725 $122,300 $198,050

33% $178,650 $388,350 $217,450 $388,350 $108,725 $194,175 $198,050 $388,350

35% Over $388,350 Over $388,350 Over $194,175 Over $388,350

This is for 2012, sso make the adjustment for 2013. Which is the charts point. But again, LOLberals are not good at math or economics.

The rates you posted are lies for the average person. A 28% effective tax rate for federal income taxes is for the highest income earners.

Please pay attention.

I was posting that photo, which came from the OP (first post) of this thread.

I was using it to illustrate that my opinion on paying taxes for various city/state services, to contradict what Newby said.

I couldn't agree more, the info supplied in that image is crap... But, what else can be expected from a Heritage.org propaganda poster?

Government has always taken close to half your paycheck.

And yet somehow we've managed to survive.

We have a 1.3 trillion dollar defict We are not surviving much longer with that.

No, we will have to raise taxes which has been done in the past when taxes are cut, then fees and taxes in other areas are raised or new ones implemented.

Reagan raised taxes 11 times to offset his tax cuts and military spending which increase 4 fold. Clinton raised them and so did Bush jr, he raised fees mostly.

If Congress does not act on the Bush era tax cuts then we shall see taxes raised and 1 trillion in budget cuts.