- Oct 18, 2011

- 22,280

- 12,790

- 1,405

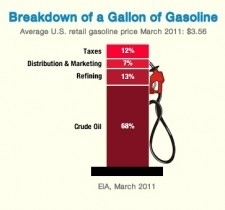

Regardless of the price, $2, $6, or$10, is the oil company's profit margin greater or lesser than the government's margin (if any) ? Between the government and the oil company, who incurs more risk to get its margin?