Skynet

Member

- Jun 8, 2011

- 456

- 22

- 16

- Thread starter

- #101

I did.

DO you not understand what tax credits are?

Do you knwo what LIHTC are? Section 42?

Read up on it.

Got a lunch meeting....cya

i dont think you understand the difference between personal taxes and business taxes...

Im back.

And yes...I do understand the difference. Afterall, I am a business owner. My company specializes in business planning and human resource solutions. Part of what I do is analyze the tax advantages of alternative decisions.

You see....there are many different ways a company can avoid paying taxes...but by no means does it mean the company is not paying their fair share.

For example....in an LLC...or an S-corp.....the ownership can leave excess revenue available at the end of the calandar year....and that will be taxed....or he/she can take the excess revenue as a distribution and have their existing corporate liquid capital be near 0 and pay no corporate taxes.....BUT....now they will pay it as personal taxes...so either way, tax is paid on the money.

In a large corporation.....the "profits" can be distributed as bonuses.....and therfore very little left to be taxed....but those bonuses? They are now personal income for the recipients of the bonuses...and they must pay taxes on them.

So you see.....even with tax credits aside.....whether or not corporations pay taxes is irrelevant......as the revenue (profit) is ultimately taxed anyway.

Seems to me you listen to the rhetoric...and dont really understand the situation.

small business taxes are on a different level than corporate taxes. for your business that may be the case.

case in point when a major corporation like Exxon makes a $19 billion profit but received a $156 million tax refund. im pretty sure that didnt use $19 billion to pay their bonuses and invest in new technology.

Bank of America received a $1.9 billion tax refund from the IRS last year, although it made $4.4 billion in profits and received a bailout from the Federal Reserve and the Treasury Department of nearly $1 trillion.

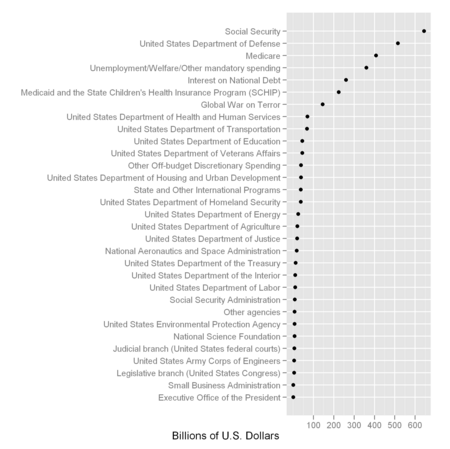

Ten giant U.S. companies avoiding income taxes: Sen. Bernie Sanders list - Lynn Sweet

small business taxes should remain low, as they provide the lions share of jobs to americans. but large corporations find the loops holes and exploit them. this practice need to be addressed.