- Nov 26, 2011

- 123,518

- 54,591

- 2,290

GOP senator offers 'fiscal cliff' solution - Business - Boston.com

Both tax increases and adjustment to entitlements involved. Grover must be soiling his pants...

FINALLY! Some ideas on the table instead of attacks.

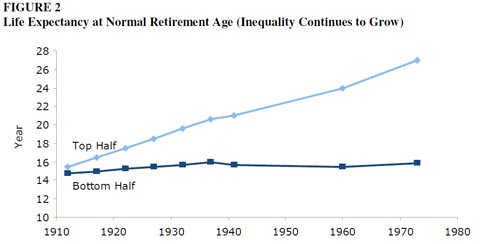

Something I have been in favor of for a long time. We are living longer, we should be working longer.

However, 68 and 67 are nowhere near high enough. Both need to be at least 70.

Life expectancy was 60 when Social Security was implemented. Social Security was insurance in case you beat the odds, not an entitlement.

6 percent of the population was over 65 when Social Security was enacted. Today, 13 percent are over 65. We have literally more than doubled the Social Security load on the Treasury. When you add Medicare on top of that, it is no wonder we are seriously broken.

Life expectancy is now 78 and will keep on climbing.

The eligibility ages should either be indexed to life expectancy or to a percentage of the population.

Corker’s plan also includes $749 billion in higher tax revenue claimed by capping itemized deductions at $50,000, a proposal that hits wealthier taxpayers the hardest.

Wrong answer.

We need to remove ALL tax expenditures from the tax code. Every last one of them.

If a Congressman cannot tinker with the tax code by attaching a rider to a bill that adds another tax expenditure, then giving him campaign cash to do so becomes pointless. He cannot be bribed.

We have been adding tax expenditures at the rate of one a day for over a decade. It has become so corrupt that they now add up to a trillion dollars a year.

Get rid of them all. This will truly broaden the base, and then you can lower the tax rates for everyone. And you can broaden the base to include more than 47 percent of income earners so that more people have skin in the game.

This way, if your neighbor earns the same paycheck you do, you are both paying the identical amount of taxes.

It does not get more fair than that.

.

Just pointing out that the tax itself was only 3% when SS was fully implemented so we have also doubled the amount taken in for each worker as well.

Yes, and that is a 100 percent tax increase to pay for the extra years you draw from the Treasury in your retirement.

Instead of continuing to raise taxes, we need to raise the eligibility age. That is a spending cut instead of the usual tax increase.

.