Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gas went from 3.61 to 3.99 withing minutes.

- Thread starter bigrebnc1775

- Start date

- Banned

- #62

Because it's unprofitable to maintain old ones, or build new ones. Make less expensive to build new ones, the choke point goes away or at least gets less of a choke. Decrease gas formulations to under 10 instead of the near 40 that currently exist (IIRC) more production can go into fewer blends instead of being split into boutique blends.

Many things can be done to alleviate this stress... but this admin will not do it. In fact, they will go out of their way to make it worse.

It would be unprofitable to have full refining capacity no matter how cheap we made it to make new refineries.

As long as energy companies can make choke-points at the refineries, they can keep up the price of gas (thus keeping their profits up with less effort), and profit from the higher gas prices via dark market trading.

Which is why, if you firmly believe the President needs to address the issue, it may be time for some nationalizing of the refining industry.

- Banned

- #63

There were a fair number of people on the left blaming Bush, to be fair to their argument. I considered it stupid at the time and said so, because the same factors driving it today were driving it then.

Truth.

- Thread starter

- #64

It is a choke point, because refining capacity is now even lower than the current (low) demand.

If demand rises again, we're all seriously fucked.

When demand is low not much oil is flowing to those choke points, there for no choke point or nothing noticeable.

There is not enough of a demand reduction to negate the effect of these refinery closures.

And certainly if demand goes back up in the future, we'll all be fucked royally.

Question, why would refineries stay open if demand is down?There is not enough of a demand reduction to negate the effect of these refinery closures.

If is not nowAnd certainly if demand goes back up in the future, we'll all be fucked royally.

- Thread starter

- #65

What was the value of the dollar when Bush was president compared to now?There were a fair number of people on the left blaming Bush, to be fair to their argument. I considered it stupid at the time and said so, because the same factors driving it today were driving it then.

It's a sad thing... I remember when gas was 29 cents a gallon.

I remember paying 33 cents a gallon you old fart.

When I was a kid it was 19 cents a gallon.

By Nov it should be at 10 bucks a gallon.

Shit, it will take your whole paycheck to fill the damned car.

- Banned

- #67

Question, why would refineries stay open if demand is down?

If is not now

For the same reason factories stay open during lulls in product sales:

Demand will go up again.

Especially since the cost of building new refineries is quite high compared to upgrading or expanding existing refineries.

Decepticon

Rookie

- Jan 11, 2012

- 1,138

- 189

- 0

- Banned

- #68

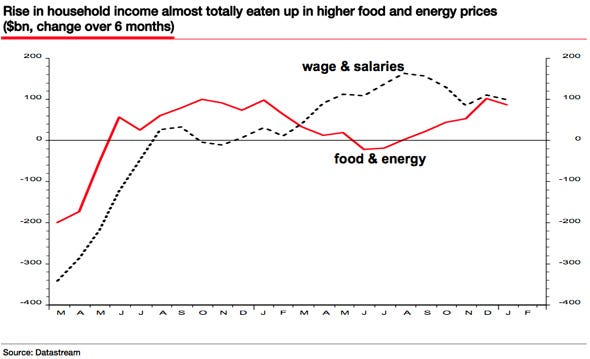

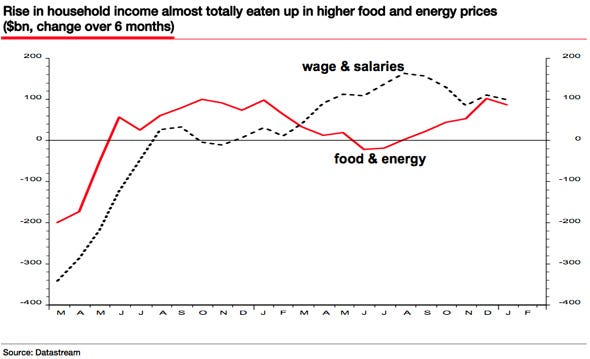

Gee, if only wages had kept pace with the price of gas!

- Banned

- #69

This is a good point.

And the energy companies have made sure that the price of oil remains high, through artificial means, to ensure these commodity prices remain high.

After all, they have also been trading futures on their own product.

What was the value of the dollar when Bush was president compared to now?There were a fair number of people on the left blaming Bush, to be fair to their argument. I considered it stupid at the time and said so, because the same factors driving it today were driving it then.

Relative to the Euro? About the same as it was in 2008.

Relative to the pound? It's around a ten year high.

Last edited:

- Banned

- #71

What was the value of the dollar when Bush was president compared to now?There were a fair number of people on the left blaming Bush, to be fair to their argument. I considered it stupid at the time and said so, because the same factors driving it today were driving it then.

Relative to the Euro? About the same as it was in 2008.

Relative to the pound? It's around a ten year high.

Yup, and if you do a recent historical comparison, the price of oil has generally not closely followed the value of the dollar.

- Thread starter

- #72

Question, why would refineries stay open if demand is down?

If is not now

For the same reason factories stay open during lulls in product sales:

Demand will go up again.

Especially since the cost of building new refineries is quite high compared to upgrading or expanding existing refineries.

Projecting is not now that was the argument of polk, Isn't that right POLK?. Demand is down.

What was the value of the dollar when Bush was president compared to now?

Relative to the Euro? About the same as it was in 2008.

Relative to the pound? It's around a ten year high.

Yup, and if you do a recent historical comparison, the price of oil has generally not closely followed the value of the dollar.

I've never looked at it, but that makes sense, as the other variables are much larger.

Question, why would refineries stay open if demand is down?

If is not now

For the same reason factories stay open during lulls in product sales:

Demand will go up again.

Especially since the cost of building new refineries is quite high compared to upgrading or expanding existing refineries.

Projecting is not now that was the argument of polk, Isn't that right POLK?. Demand is down.

Projection isn't now, but people still make plans based on expectations.

- Thread starter

- #75

Monthly Exchange Rate Average (American Dollar, Euro) 2008 - x-ratesWhat was the value of the dollar when Bush was president compared to now?There were a fair number of people on the left blaming Bush, to be fair to their argument. I considered it stupid at the time and said so, because the same factors driving it today were driving it then.

Relative to the Euro? About the same as it was in 2008.

Relative to the pound? It's around a ten year high.

March 2008 1.55202 USD

March 2012 1.31581 USD

2012

Any questions?

- Thread starter

- #76

For the same reason factories stay open during lulls in product sales:

Demand will go up again.

Especially since the cost of building new refineries is quite high compared to upgrading or expanding existing refineries.

Projecting is not now that was the argument of polk, Isn't that right POLK?. Demand is down.

Projection isn't now, but people still make plans based on expectations.

Demand is down right now right?

Projecting is not now that was the argument of polk, Isn't that right POLK?. Demand is down.

Projection isn't now, but people still make plans based on expectations.

Demand is down right now right?

No. Demand increased each of the last two years and is projected to increase this year.

- Thread starter

- #78

Projection isn't now, but people still make plans based on expectations.

Demand is down right now right?

No. Demand increased each of the last two years and is projected to increase this year.

I posted several links that demand was down.

- Thread starter

- #80

No, you didn't. You posted several links claiming that American demand was projected to decline. The oil market is larger than just the United States.

You don't read do you? Plus it was part of your argument that it's projected demand will rise. I think you made that claim on page two or three.

You are not reading anything from those links?Neither of your links say demand is down. It says there are fears demand may decrease. Potential does not equal actual.

MIXED U.S. DATA

U.S. equities managed to edge higher on data showing U.S. consumer confidence hit a one-year high in February. But an earlier report showing U.S. durable goods orders fell the most in three years in January kept concerns that high oil prices will limit economic growth intact.

American trucks carried less tonnage in January after logging the largest increase in 13 years in December, the American Trucking Associations said, another cautionary signal regarding the economy.

U.S. gasoline demand rose last week versus the previous week, but remained 6.9 percent below the year-ago period, MasterCard said in a weekly report.

OK I'll give you last week demand was up but the previous week demand was down and is down for the year.

Imagine that

Similar threads

- Replies

- 23

- Views

- 347

- Replies

- 8

- Views

- 99

- Replies

- 26

- Views

- 255

- Poll

- Replies

- 0

- Views

- 92

- Replies

- 71

- Views

- 940

Latest Discussions

- Replies

- 7

- Views

- 8

- Replies

- 20

- Views

- 76

- Replies

- 204

- Views

- 949

- Replies

- 244

- Views

- 997

Forum List

-

-

-

-

-

Political Satire 8039

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 468

-

-

-

-

-

-

-

-

-

-