1. Assure the Capital Markets and the world that she (or he) understand why American is the Number one economy and best country on Earth and will use government to help it instead of destroy it.

2. If we fall short of a veto-proof majority, use her (or his) power as Executive to totally remake Federal Agencies, transforming them into Agencies that will work WITH American business instead of AGAINST American business. Don't get hung up on closing HUD, DoEd etc. FIRE EVERYONE and replace them with people who will carry out a Pro-American agenda. Libs will complain, but nobody will listen

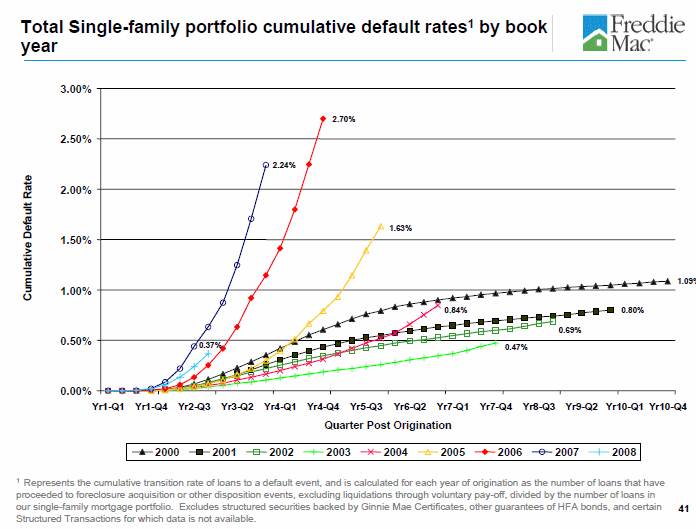

3. We have a real estate mess that continues to fester. Close Fannie and Freddie, sell their entire SFH portfolio at auction and allow individual to invest their 401k in real estate asset.

4. Robust domestic energy program, drill baby drill!!

5. repeal ObamaCare in favor of the Whole Food recommendaations

i thought the priority should be on a flag-burning-banning amendment.