NYcarbineer

Diamond Member

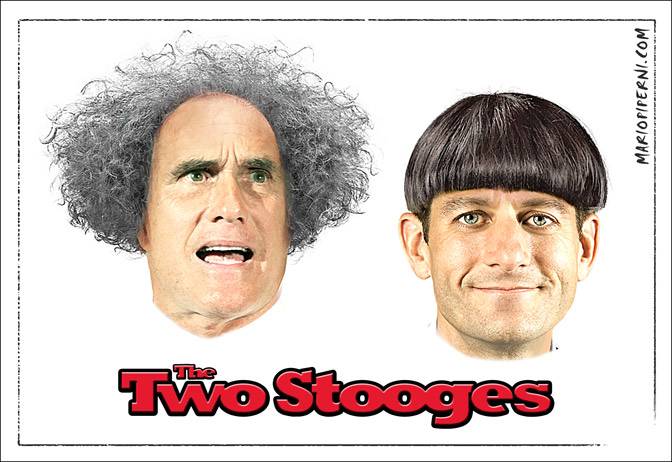

So Romney is now repudiating 'trickle-down'?

He's claiming he's NOT going to cut taxes for the wealthy (his vaunted job-creators) but will cut taxes for the middle class?

...and that will stimulate growth????

He's claiming he's NOT going to cut taxes for the wealthy (his vaunted job-creators) but will cut taxes for the middle class?

...and that will stimulate growth????