Trajan

conscientia mille testes

so who's surprised at this?? Make something easier to obtain, abrogate responsibility, let the Feds run it.....viola' for silliness and fiscal pain.

My daughter tells me of friends and hears stories of students who use the Pell grant to pay their Comm. college tab then take loans for $ 3-4K per semester as pocket money, while running up CC debt to boot.

Updated November 28, 2012, 11:48 a.m. ET

Federal Student Lending Swells

snip-

U.S. student-loan debt rose by $42 billion, or 4.6%, to $956 billion in the third quarter, the Federal Reserve Bank of New York said Tuesday. Overall household borrowing fell during that period.

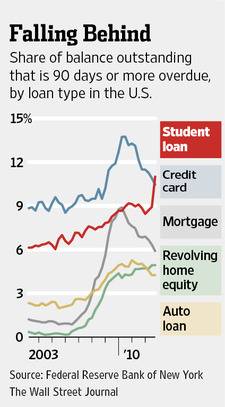

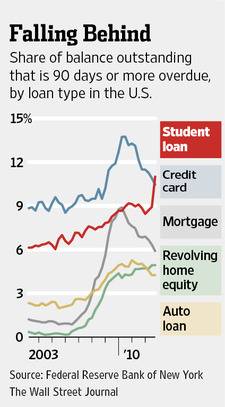

Payments on 11% of student-loan balances were 90 or more days behind at the end of September, up from 8.9% at the end of June, a rate that now exceeds that for credit cards. Delinquency rates for all other consumer-debt categories fell or were flat.

Nearly all student loans93% of them last yearare made directly by the government, which asks little or nothing about borrowers' ability to repay, or about what sort of education they intend to pursue.

President Barack Obama championed easy-to-get loans during the campaign, calling higher education "an economic imperative in the 21st century." A spokesman for Education Secretary Arne Duncan said the goal is "to make student loans available to as many people as possible," and requiring minimum credit scores would block many Americans from going to college.

But rising student-debt burdens and stories about students and parents drowning in debt, coming just a few years after aggressive mortgage lending triggered a financial crisis, is focusing attention on risks to the government and borrowers.

"Is there any way the federal government could possibly come out to the good?" Sen. Bob Corker (R., Tenn.) asked at a Senate Banking Committee hearing in July on student loans, noting that the government demands no collateral and has no underwriting requirements. "What we're really doing is piling up debt down the road the same students are going to have to pay off."

Others are asking whether the government is encouraging students to take on too much debt. "The way the system works now put money on the stump, people come and get it," said Anthony Carnevale, director of Georgetown University's Center on Education and the Workforce. "Can't blame them. It's sitting out there in plain view. It's easy to get."

more at-

Federal Lending Push Swells Student Debt - WSJ.com

My daughter tells me of friends and hears stories of students who use the Pell grant to pay their Comm. college tab then take loans for $ 3-4K per semester as pocket money, while running up CC debt to boot.

Updated November 28, 2012, 11:48 a.m. ET

Federal Student Lending Swells

snip-

U.S. student-loan debt rose by $42 billion, or 4.6%, to $956 billion in the third quarter, the Federal Reserve Bank of New York said Tuesday. Overall household borrowing fell during that period.

Payments on 11% of student-loan balances were 90 or more days behind at the end of September, up from 8.9% at the end of June, a rate that now exceeds that for credit cards. Delinquency rates for all other consumer-debt categories fell or were flat.

Nearly all student loans93% of them last yearare made directly by the government, which asks little or nothing about borrowers' ability to repay, or about what sort of education they intend to pursue.

President Barack Obama championed easy-to-get loans during the campaign, calling higher education "an economic imperative in the 21st century." A spokesman for Education Secretary Arne Duncan said the goal is "to make student loans available to as many people as possible," and requiring minimum credit scores would block many Americans from going to college.

But rising student-debt burdens and stories about students and parents drowning in debt, coming just a few years after aggressive mortgage lending triggered a financial crisis, is focusing attention on risks to the government and borrowers.

"Is there any way the federal government could possibly come out to the good?" Sen. Bob Corker (R., Tenn.) asked at a Senate Banking Committee hearing in July on student loans, noting that the government demands no collateral and has no underwriting requirements. "What we're really doing is piling up debt down the road the same students are going to have to pay off."

Others are asking whether the government is encouraging students to take on too much debt. "The way the system works now put money on the stump, people come and get it," said Anthony Carnevale, director of Georgetown University's Center on Education and the Workforce. "Can't blame them. It's sitting out there in plain view. It's easy to get."

more at-

Federal Lending Push Swells Student Debt - WSJ.com