- May 20, 2009

- 144,098

- 66,366

- 2,330

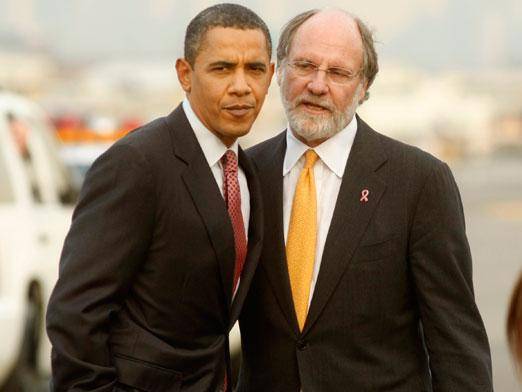

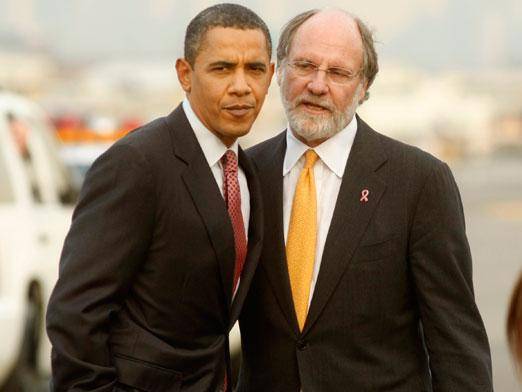

The financial architect of Obama's failed Stimulus plan, Jon Corzine, a major Obama fund raiser who was on the short list to replace Timmy Geithner as SetTres appeared before Congress and testified that he had no idea where $1.2B of customer funds.

Maybe Congress should have ask the CEO? Oh wait, Corzine was the CEO!

See, Libs, this is what a CEO does, he runs the company. I think that's why there's always a big disconnect between reality and Neo-Marxist Democrats ideas about what a CEO does, about what the job description is.

Lehmann and BearStearns both went bankrupt and guess how much customer money went missing?

Come on, guess.

NOT A SINGLE FUCKING NICKLE!

This is why the US economy is in tatters, it's run by an Administration that takes its economic advise from criminals and failures.

[ame=http://www.youtube.com/watch?v=4p4-vPrcDBo]Obama: Shovel Ready jobs not shovel ready - YouTube[/ame]

Maybe Congress should have ask the CEO? Oh wait, Corzine was the CEO!

See, Libs, this is what a CEO does, he runs the company. I think that's why there's always a big disconnect between reality and Neo-Marxist Democrats ideas about what a CEO does, about what the job description is.

Lehmann and BearStearns both went bankrupt and guess how much customer money went missing?

Come on, guess.

NOT A SINGLE FUCKING NICKLE!

This is why the US economy is in tatters, it's run by an Administration that takes its economic advise from criminals and failures.

[ame=http://www.youtube.com/watch?v=4p4-vPrcDBo]Obama: Shovel Ready jobs not shovel ready - YouTube[/ame]