LibocalypseNow

Senior Member

- Jul 30, 2009

- 12,337

- 1,368

- 48

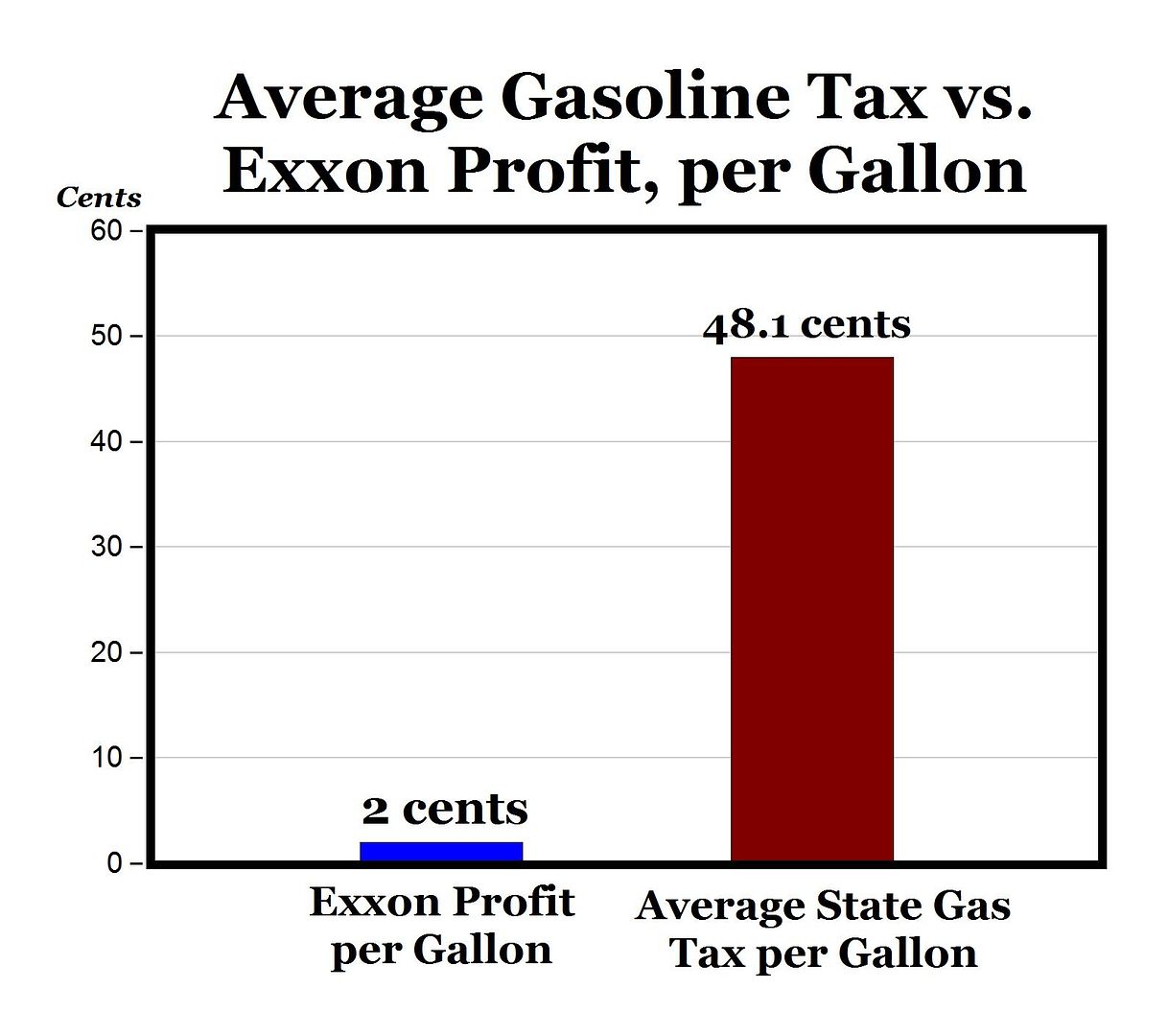

Maybe Obomba can get his good buddies over GE to start paying some Taxes too. Exxon paid an estimated $10 Billion in Taxes. Maybe the Exxon or Shell CEO should be "Jobs Czar" rather than GE CEO Jeffrey Immelt? Just a thought anyway...

Exxon earns nearly $11B in 1Q, best since '08 - Yahoo! Finance

Exxon earns nearly $11B in 1Q, best since '08 - Yahoo! Finance