Si modo

Diamond Member

- Thread starter

- #81

No.

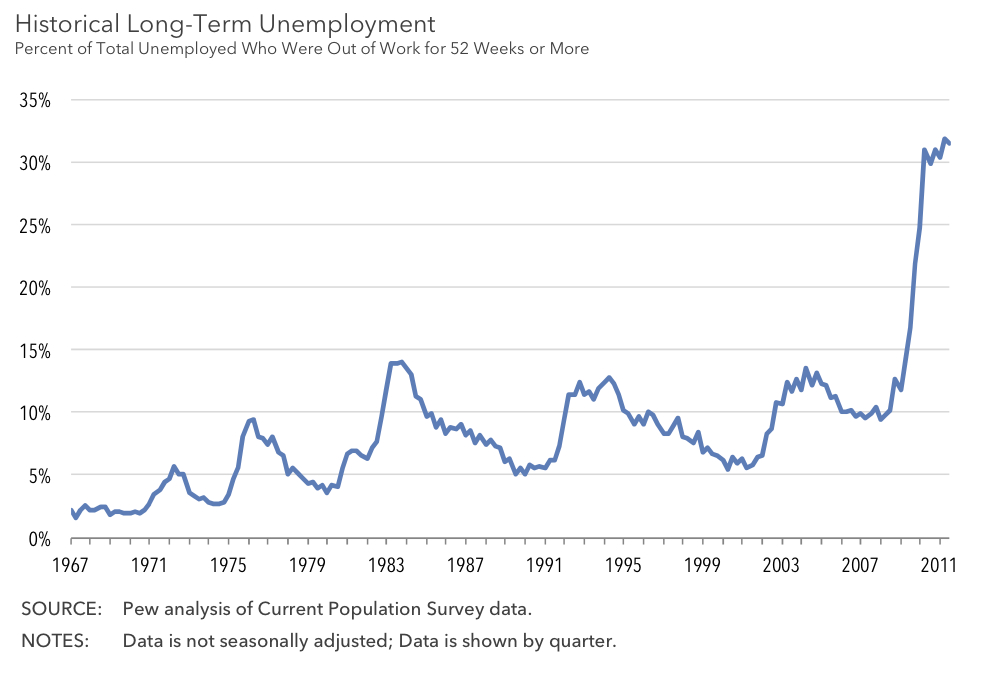

As you can see, the decline began in the late 90s. During Bush's 8 years in office, only 3 million jobs were created, until the recession, upon which all those gains were lost and then some.

During Clinton's 8 years, 25 million jobs were created.

Obama's pretty much had zero job growth in three years.

While domestic policy has some part in this, I think the larger part has to do with the collapse of the Soviet Union which led to India and China seeing the writing on the wall for central planning, which caused them to start moving toward free market economies. Suddenly, the world labor market was flooded with 2 billion additional workers competing to build your lava lamps, iPads, big screen TVs, and so forth.

Our labor force is puny in the face of this labor tidal wave. That we would be drowned by it was predicted many years ago.

Domestic wage and job suppression are to be expected as a result. And until these 2 billion laborers catch up with us in wages and benefits, the damper effect will be with us.

There are signs their standards of living are moving upward. The Foxcomm workers revolt is one example.

This is not excusing Obama. In fact, I have never even heard Obama mention this cause and effect. He's clueless, actually.

But it does go a long way toward explaing Bush's weak job growth and Obama's almost non-existent recovery. Our labor force's immune system was extremely weakened by cheap labor competition, so it could not battle the kind of recessionary blow it took in 2008. Thus the slow climb back.

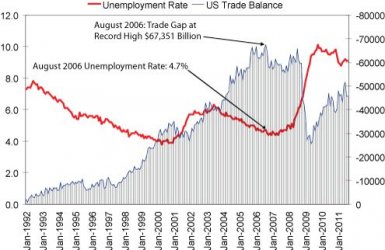

Trade inbalance, ie; deficit, is the main reason for job losses in the past decade, and the reason for devaluation of the dollar.

So really it was not just bush's or Obama's fault. It is you the consumers also.

There has been no correlation between unemployment and trade deficit recently.

waaaaaaaa waaaaaa

waaaaaaaa waaaaaa