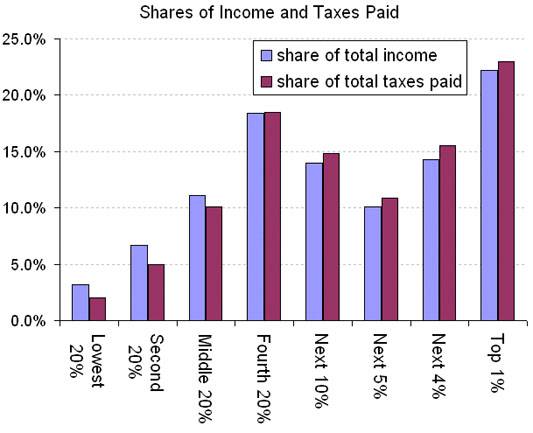

In the United States, the very rich earn a large share of the income, and are taxed at slightly higher rates than the general population. Here's the picture of shares of income and shares of the total tax burden:

...

On the 47% of those who don't pay income taxes

The 47 percent number is not wrong. The stimulus programs of the last two years the first one signed by President George W. Bush, the second and larger one by President Obama have increased the number of households that receive enough of a tax credit to wipe out their federal income tax liability.

But the modifiers here federal and income are important. Income taxes arent the only kind of federal taxes that people pay. There are also payroll taxes and investment taxes, among others. And, of course, people pay state and local taxes, too.

Even if the discussion is restricted to federal taxes (for which the statistics are better), a vast majority of households end up paying federal taxes. Congressional Budget Office data suggests that, at most, about 10 percent of all households pay no net federal taxes. The number 10 is obviously a lot smaller than 47.

The reason is that poor families generally pay more in payroll taxes than they receive through benefits like the Earned Income Tax Credit. Its not just poor families for whom the payroll tax is a big deal, either. About three-quarters of all American households pay more in payroll taxes, which go toward Medicare and Social Security, than in income taxes.

Here's another way to put it. Americans pay different kinds of taxes to different entities. State and local taxes tend to be regressive. Payroll taxes, which fund Social Security and Medicare, are also regressive. To balance this out, we have a pretty progressive income tax. If you focus only on the income tax, it makes it look like the rich are getting screwed. But of course the income tax is just one element.

No, Half Of All Workers Aren't Freeloaders | The New Republic