"If You Make $250,000 A Year Or Less, We Will Not Raise Your Taxes. We Will Cut Your Taxes." (Barack Obama, Remarks, Powder Springs, GA, 7/8/08) Barack Obama

OBAMA AD: "The Obama Plan: Families Making Less Than $200,000 Get Tax Cut."

"What we're saying is that $87 billion tax break doesn't need to go to people making an average of 1.4 million, it should go like it used to. It should go to middle class people -- people making under $150,000 a year." (Joe Biden, Interview With WNEP Scranton, 10/27/08

Middle class families will see their taxes cut and no family making less than $250,000 will see their taxes increase. The typical middle class family will receive well over $1,000 in tax relief under the Obama plan, and will pay tax rates that are 20% lower than they faced under President Reagan.

http://www.barackobama.com/pdf/taxes/Factsheet_Tax_Plan_FINAL.pdf

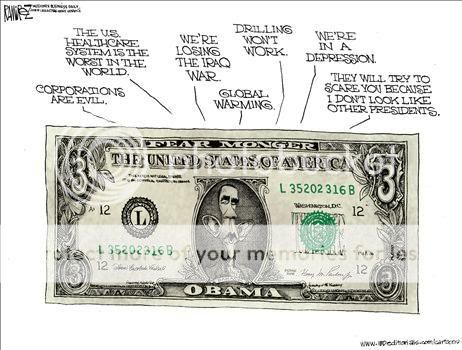

On a personal level I would like to know in the ever changing definition of wealthy according to Barack Obama, which I am to believe? Am I to believe his latest 30 minute video presentation, or his tax policy on his own web page or his Vice Presidential candidate when it comes to his tax plan. As this plan will not come into play until the Bush Administration's tax cuts expire in 2010, is it clear that by 2011 when a tax program will get implemented, will these same definitions hold true?

OBAMA AD: "The Obama Plan: Families Making Less Than $200,000 Get Tax Cut."

"What we're saying is that $87 billion tax break doesn't need to go to people making an average of 1.4 million, it should go like it used to. It should go to middle class people -- people making under $150,000 a year." (Joe Biden, Interview With WNEP Scranton, 10/27/08

Middle class families will see their taxes cut and no family making less than $250,000 will see their taxes increase. The typical middle class family will receive well over $1,000 in tax relief under the Obama plan, and will pay tax rates that are 20% lower than they faced under President Reagan.

http://www.barackobama.com/pdf/taxes/Factsheet_Tax_Plan_FINAL.pdf

On a personal level I would like to know in the ever changing definition of wealthy according to Barack Obama, which I am to believe? Am I to believe his latest 30 minute video presentation, or his tax policy on his own web page or his Vice Presidential candidate when it comes to his tax plan. As this plan will not come into play until the Bush Administration's tax cuts expire in 2010, is it clear that by 2011 when a tax program will get implemented, will these same definitions hold true?