- Sep 9, 2012

- 40,718

- 13,425

- 2,280

You do realize as a company regains more control of their companies, they have more leverage with their Boards, right? What are Boards all about? ‘Bring us more profit off the backs of everyone!’

Some time research and see who sits on these Boards. You might be shocked.

Some time research and see who sits on these Boards. You might be shocked.

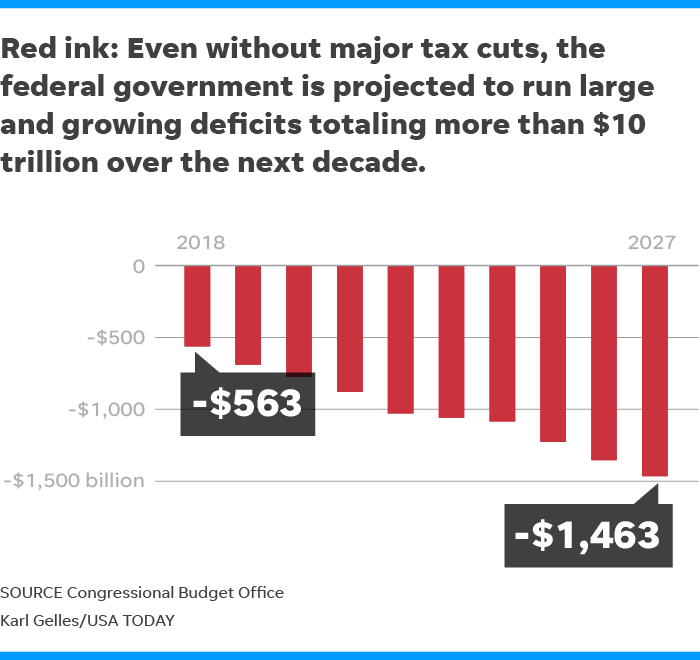

Oh no, this bill will be very good for stocks.According to Goldman Sachs, the former employer of Trump's chief economic adviser, this tax bill will only increase growth 0.3% for 2018 and 2019 before either flat-lining, or producing negative growth beginning in 2020.

Goldman Sees U.S. Tax Cut Boosting Growth 0.3% Point in 2018-19

The U.S. Congress will probably pass tax-cut legislation within the next two weeks, ushering in reductions that will boost economic growth by around 0.3 percentage point for next year and 2019, according to estimates by Goldman Sachs Group Inc.

Goldman Sachs doesn't think the Republican tax bill would be a big boost to the US economy

We note that the effect in 2020 and beyond looks minimal and could actually be slightly negative," the Goldman economists wrote.

Even Wall Street thinks this bill sucks.

U.S. investors target 'buyback stocks' in bet on Trump tax plan

But as you say, not so good for the economy