dmitrievsky

Rookie

- Sep 11, 2012

- 6

- 0

- 1

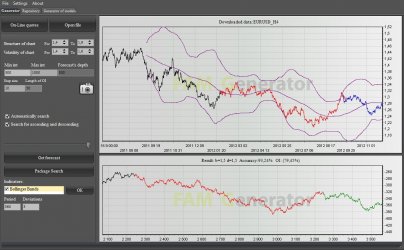

Good afternoon. The market situation is characterized by a high probability of a decline for the euro-dollar. In the picture you can see the basic scenario for the current week, resistance is located at 1.2820 area, the goal of 1.2520, the timing of the forecast - up to 17-18 September. I wish you a successful trading this week!