There are two neighbors who live in a subdivision. One neighbor is Hans, the other is Nikos. They both bought similar houses next to each other at about the same time for the same price. Hans put 20% down to buy his house and borrowed 80%. It has a fixed interest rate and his payment is well within his means. Nikos also has a mortgage, but he put 5% down and borrowed 95% with a variable interest rate. Nikos stretches to meet his mortgage payment every month.

Hans is an automobile engineer. Nikos is a clerk for the government. Hans is more productive than Nikos and earns more money. Hans works 50 hours a week while Nikos works 35 hours a week and gets every third Friday off. Nikos could work longer, but the weathers nice so he chooses not to. Hans plans to retire at 67 and is saving for retirement. Nikos plans to retire at 57, but he doesnt have much savings and is running up his credit cards buying lots of stuff.

But Nikos is putting too much on his credit card. He can no longer maintain his lifestyle and pay his debts. One day, Nikos skips a mortgage payment. The bank decides to check his credit rating. It has fallen dramatically. The bank then checks Nikoss income. The bank discovers that Nikos lied about how much money he made on his mortgage application. So the bank calls Nikos and tells him they have to either raise his interest rate or cancel the mortgage. This is a problem for Nikos because hes maxed out his credit card and cant borrow from anywhere else.

So Nikos goes to his neighbor, Hans, and asks him for a loan. Hans, who likes Nikos but disapproves of his free-spending ways, says OK, but on the following conditions

* Nikos has to get a higher paying job, which would require him to work longer and not take a long weekend every three weeks.

* Nikos cant retire at 57. He has to work to 67.

* Nikos has to start paying down all his other debt.

* Nikos has to start saving more.

Nikos says No way. I like my lifestyle. Im not giving it up.

Hans replies, Well, I work hard for my money. If you arent willing to alter your lifestyle, Im not lending you anything. Why should I lend you my hard-earned savings if you arent willing to change your free-spending ways?

But I deserve to live this way! Nikos yells.

Sorry, says Hans.

Nikos goes across the street to Francois. Francois and Nikos have always gotten along pretty well, so Nikos asks for Francois for a loan. Francois is afraid that Nikos may have to sell his home and move. Francois doesnt want Nikos to move because he is banging Nikoss hot Greek wife, so he lends him the money.

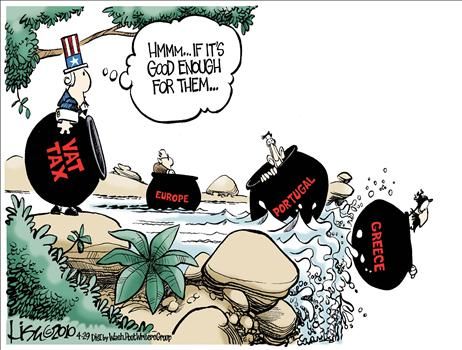

And that is the eurozone.

Hans is an automobile engineer. Nikos is a clerk for the government. Hans is more productive than Nikos and earns more money. Hans works 50 hours a week while Nikos works 35 hours a week and gets every third Friday off. Nikos could work longer, but the weathers nice so he chooses not to. Hans plans to retire at 67 and is saving for retirement. Nikos plans to retire at 57, but he doesnt have much savings and is running up his credit cards buying lots of stuff.

But Nikos is putting too much on his credit card. He can no longer maintain his lifestyle and pay his debts. One day, Nikos skips a mortgage payment. The bank decides to check his credit rating. It has fallen dramatically. The bank then checks Nikoss income. The bank discovers that Nikos lied about how much money he made on his mortgage application. So the bank calls Nikos and tells him they have to either raise his interest rate or cancel the mortgage. This is a problem for Nikos because hes maxed out his credit card and cant borrow from anywhere else.

So Nikos goes to his neighbor, Hans, and asks him for a loan. Hans, who likes Nikos but disapproves of his free-spending ways, says OK, but on the following conditions

* Nikos has to get a higher paying job, which would require him to work longer and not take a long weekend every three weeks.

* Nikos cant retire at 57. He has to work to 67.

* Nikos has to start paying down all his other debt.

* Nikos has to start saving more.

Nikos says No way. I like my lifestyle. Im not giving it up.

Hans replies, Well, I work hard for my money. If you arent willing to alter your lifestyle, Im not lending you anything. Why should I lend you my hard-earned savings if you arent willing to change your free-spending ways?

But I deserve to live this way! Nikos yells.

Sorry, says Hans.

Nikos goes across the street to Francois. Francois and Nikos have always gotten along pretty well, so Nikos asks for Francois for a loan. Francois is afraid that Nikos may have to sell his home and move. Francois doesnt want Nikos to move because he is banging Nikoss hot Greek wife, so he lends him the money.

And that is the eurozone.