California Girl

Rookie

- Oct 8, 2009

- 50,337

- 10,058

- 0

- Banned

- #21

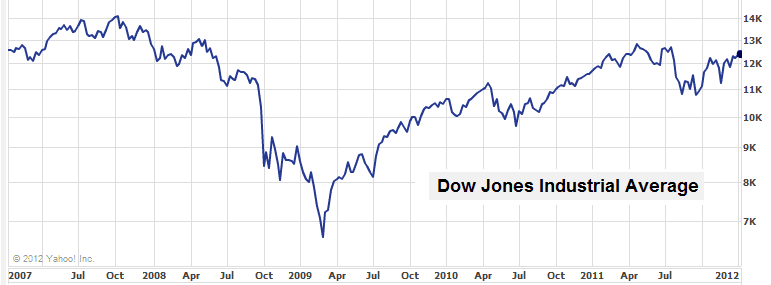

No, the economy tanked because of crazy investment products cooked up by Wall Streeters.

No, it didn't. It tanked because of a global imbalance between countries who consume too much and produce too little (like the US) and those who produce too much and consume too little (like China). But please don't let reality hit you in the ass. I know it's much more convenient to believe that 'the other guy' did it.

I disagree. The collapse of 2008 was a failure of credit markets.

I don't really give a shit whether you 'agree' or not. Global economists (real economists, not the twits on the 'left' or the 'right') agree on it - from all sides of the political spectrum. I tend to value their research based opinions over the opinion of some dude on the net.