- Thread starter

- #21

So it's not about raising taxes and cut spending like your title suggested, it's raise taxes and keep on spending, I see.....it's a failure

Maybe you don't get that I'm for ensuring prosperity. Lets start with

National Commission on Fiscal Responsibility and Reform - Wikipedia, the free encyclopedia

http://www.washingtonpost.com/r/201...al-Politics/Graphics/Gang_of_Six_Document.pdf

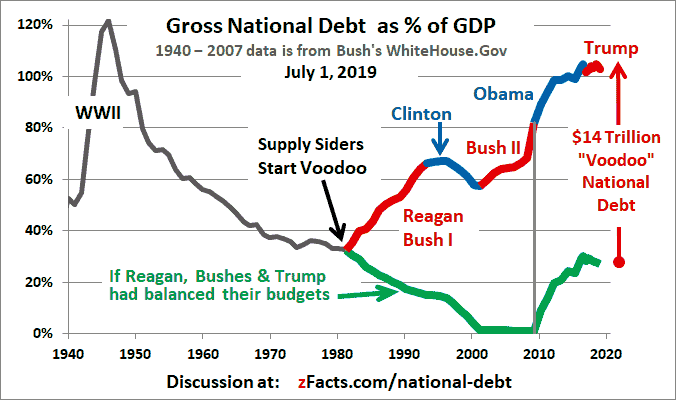

Whining about going back to the Clinton era tax rates is a failure, they worked well. It was the Bush Tax Cut, charging two wars, and a new prescription drug entitlement that fucked things up, along with moving US manufacturing overseas, and too many economic bubbles (Community Reinvestment Act, etc.).

No, that's simply not true. We never had the kind of budget deficit we do now until after July 2008. The Bush tax cuts took effect years earlier.

The issue is as I laid it out: Too much spending by Obama&Co coupled with bad economic policies leading to poor growth and lower revenues.

The tax structure under Bush was perfectly adequate.

The Tax structure under Clinton was much better...