WASHINGTON - The sluggish U.S. economy produced mixed signals Thursday about how fast it is advancing.

The U.S. government reported that orders for durable goods, those designed to last at least three years, surged three percent in December, suggesting that manufacturing is a strong segment of the national economy. Orders for cars, commercial airplanes, machinery, communications equipment and primary metals fueled the increase, the second straight monthly gain.

But two other reports depicted a more negative snapshot of the U.S. economy.

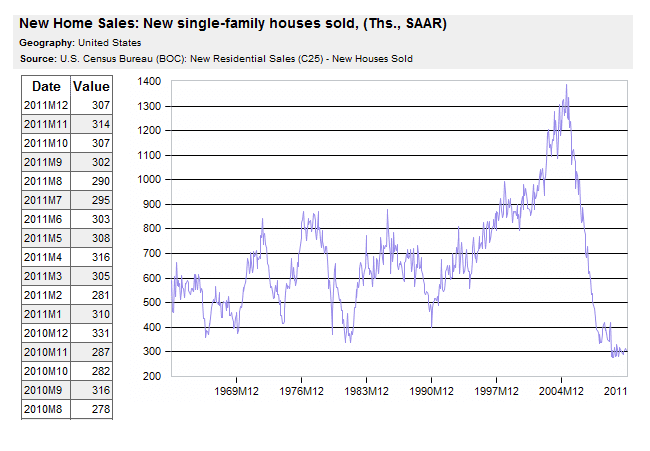

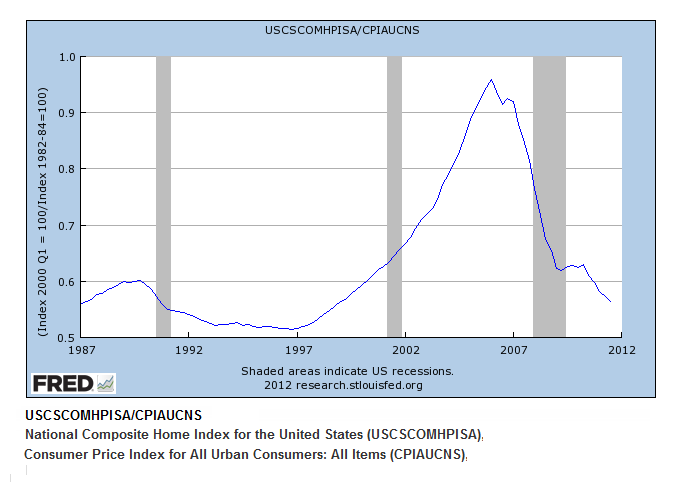

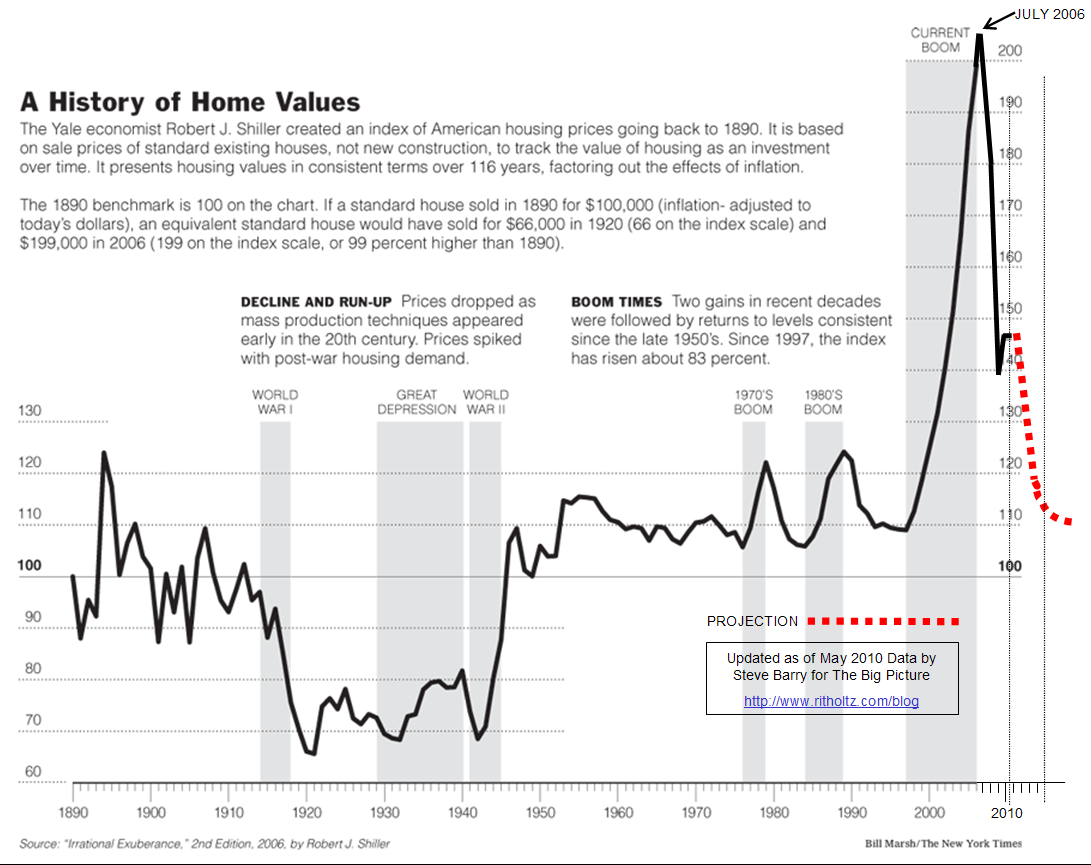

The Commerce Department said the number of new-home sales in the country was the lowest ever in 2011, based on records dating back to 1963. It said 302,000 new homes were sold last year, well less than half the 700,000 figure that economists say would represent a healthy economy.

Millions of homeowners in the U.S. have lost their homes to foreclosures when they lost their jobs and were unable to keep paying their home loans. The glut of houses for sale has pushed down prices, but stricter lending requirements have curtailed the number of buyers who qualify for new loans. Sales of existing houses, often cheaper than prices on comparable new homes, have increased in recent months.

In a third report, the government said that the number of U.S. workers making their initial claims for jobless aid increased by 21,000 last week to 377,000, after falling to a nearly four-year low the previous week. New applications for unemployment assistance have steadily fallen in recent months, averaging about the same number as last weeks total.

But economists say that the 8.5 percent national unemployment rate will not decrease much until the number of new requests for jobless aid falls consistently below 375,000, to signal that hiring has picked up. About 13 million U.S. workers are unemployed. While the labor market has improved in recent months, the country has struggled to replace the 8.7 million jobs lost during the recession from 2007 to 2009, the worst in the U.S. since the 1930s.

The countrys central bank, the Federal Reserve, announced Wednesday that it is keeping its benchmark lending rate near zero through late 2014, its latest attempt at boosting the national economy. At the same time, however, it trimmed its projection for the U.S. economy this year, saying that it may only advance by as much as 2.7 percent, down from an earlier 2.9 percent prediction.

Links

US New Home Sales Lowest In History