emptystep

VIP Member

- Jul 17, 2012

- 3,654

- 221

- 83

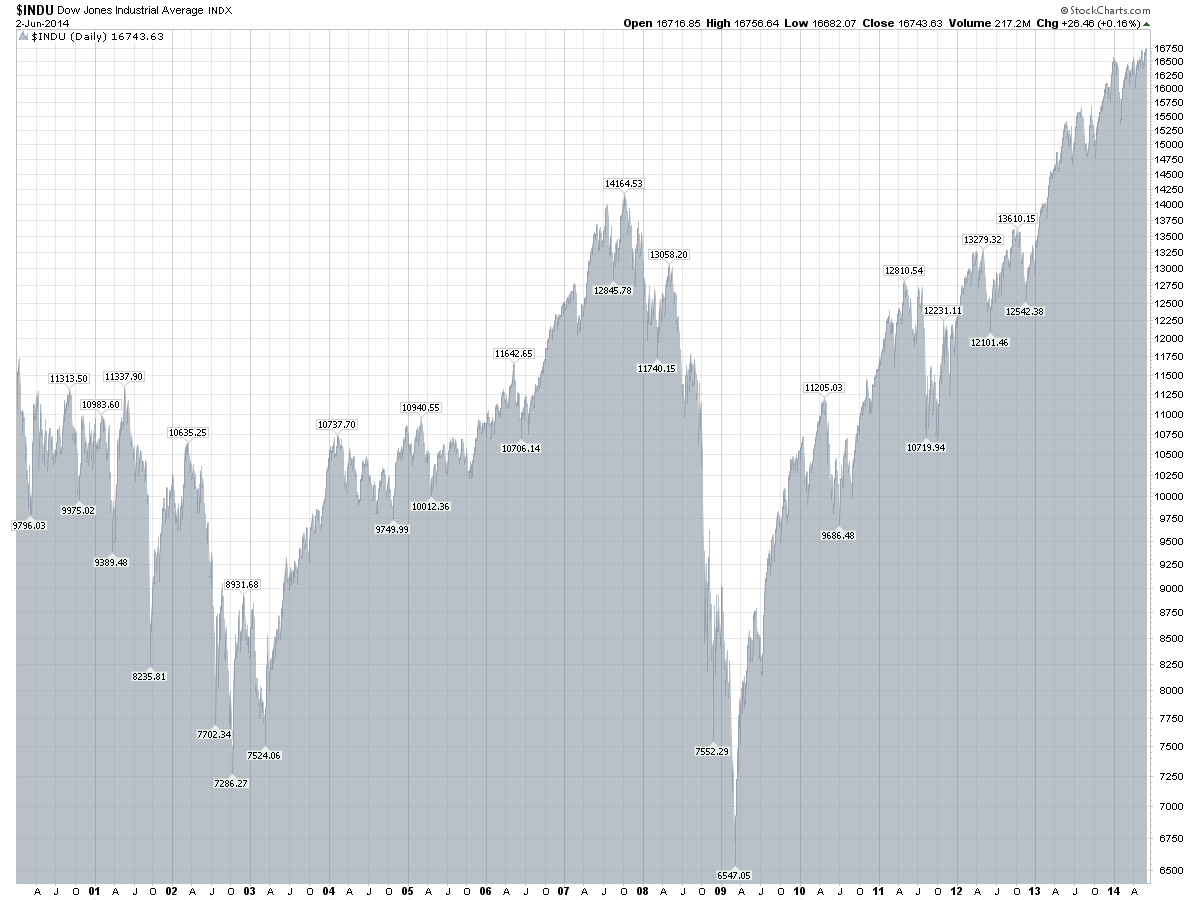

Here is a DJI chart from 2000 to current.

At the peak of the dot com bubble, January 2000, the DJI reached 11,750.28.

(Arguably the DJI would have been higher if so much money was not in the NASDAQ.)

At the peak of the housing bubble, October 11, 2007, the DJIA hit an intra-day peak of 14,198.10.

On October 5th, 2012 the DJI was at 13,610.15, not the 14, 198 high but well about the dot com bubble high of 11,750. Right now the DJI is at 13,570.31. That is 628 off the all time high of the DJI. If anyone can name a bubble at the moment I would love to hear it.

If you were in the SPDR Dow Jones Industrial Average ETF with a high of 135.64 and current price of 135.50 you would only be off by 14 cents per share.

If you look at the slope of that chart someone(s) is pouring a Hell of a lot money into the market like it was a sure thing.

Without a bubble and with a slope like that the to say the U.S. economy is on a 'rebound' is the understatement of the decade.

Before you drop all of your 401k allocation into the SPDR Dow Jones Industrial Average ETF however you should wait and see if Congress fucks everything up in the next couple of months.

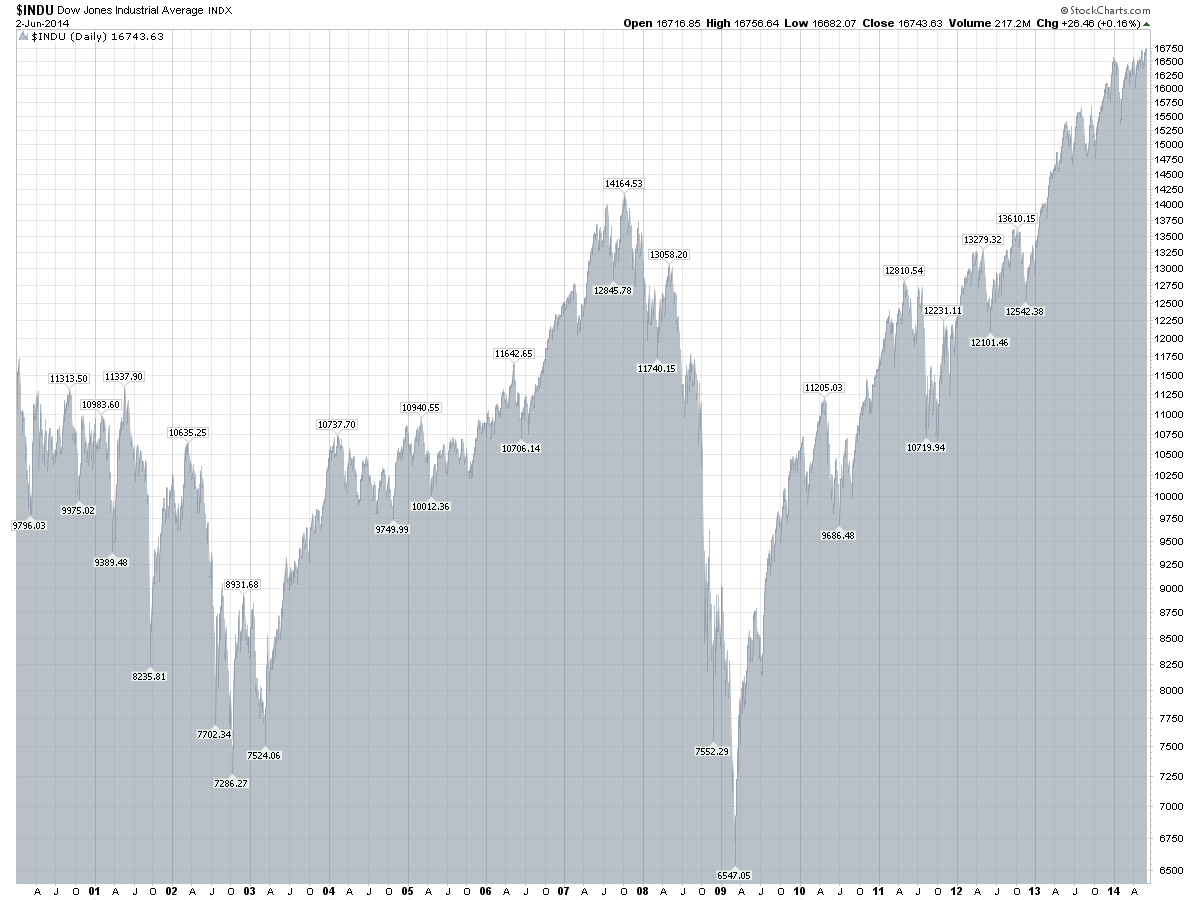

At the peak of the dot com bubble, January 2000, the DJI reached 11,750.28.

(Arguably the DJI would have been higher if so much money was not in the NASDAQ.)

At the peak of the housing bubble, October 11, 2007, the DJIA hit an intra-day peak of 14,198.10.

On October 5th, 2012 the DJI was at 13,610.15, not the 14, 198 high but well about the dot com bubble high of 11,750. Right now the DJI is at 13,570.31. That is 628 off the all time high of the DJI. If anyone can name a bubble at the moment I would love to hear it.

If you were in the SPDR Dow Jones Industrial Average ETF with a high of 135.64 and current price of 135.50 you would only be off by 14 cents per share.

If you look at the slope of that chart someone(s) is pouring a Hell of a lot money into the market like it was a sure thing.

Without a bubble and with a slope like that the to say the U.S. economy is on a 'rebound' is the understatement of the decade.

Before you drop all of your 401k allocation into the SPDR Dow Jones Industrial Average ETF however you should wait and see if Congress fucks everything up in the next couple of months.