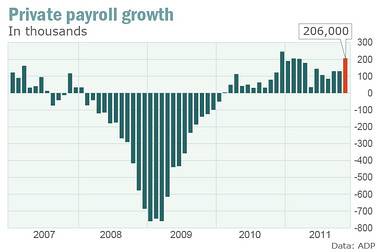

Private-sector jobs rise 206,000: ADP

Employment in the private sector rose by a seasonally adjusted 206,000 jobs in November the largest gain since last December and almost twice the average increase in recent months. The October level was revised up to 130,000 from a prior estimate of 110,000.

Novembers increase in employment normally would be associated with a decline in the unemployment rate. An acceleration of employment is consistent with data showing that GDP growth, which slowed sharply around the turn of the year, is gradually recovering, said Joel Prakken, chairman of Macroeconomic Advisers, which produces the report from anonymous payroll data supplied by Automatic Data Processing Inc.

And what should the employment number be if on a path to normalcy? This has taken 3 years! And it's hardly better.