- Feb 12, 2007

- 59,384

- 24,018

- 2,290

Hardly surprising: economic growth UNEXPECTEDLY was less robust than forecasted last quarter.

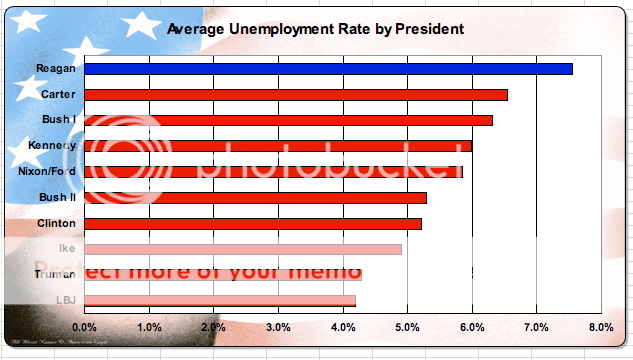

Well, that's what happens when the government increases spending and taxes, grows the size of government relative to GDP by 25% in 18 months, and increases debt to 90% of GDP. Oh, and when so much money is taken from the private sector that it doesn't create Real Productive Jobs and U6 unemployment remains near 17%.

The economic rebound last quarter turned out to be slower than first thought, one of the reasons unemployment is likely to stay high this year.

The economy grew at a 3 percent annual rate from January to March, the Commerce Department said Thursday. That was slightly weaker than an initial estimate of 3.2 percent a month ago. The new reading, based on more complete information, also fell short of economists' forecast for stronger growth of 3.4 percent.

The reasons for the small downgrade: consumers spent less than first estimated. Same goes for business spending on equipment and software. And, the nation's trade deficit was a bigger drag on economic activity.

In a separate report, the Labor Department said Thursday that the number of newly laid off workers filings claims for unemployment benefits fell by 14,000 to 460,000 last week. The decline came after claims had risen by a revised 28,000 in the previous week, the largest gain in three months.

The latest level of claims is slightly higher than it was at the start of the year. That shows the nation's workers are still facing tough times even though the overall economy is growing again.

During normal times, growth in the 3 percent range would be considered healthy. But the country is coming out the longest and deepest recession since the Great Depression. So economic growth needs to be a lot stronger - two or three times the current pace- to make a big dent in the nation's 9.9 percent unemployment rate.

Economists say it takes about 3 percent growth to create enough jobs just to keep up with the population increase. Growth would have to be about 5 percent for a full year just to drive the unemployment rate down 1 percentage point.

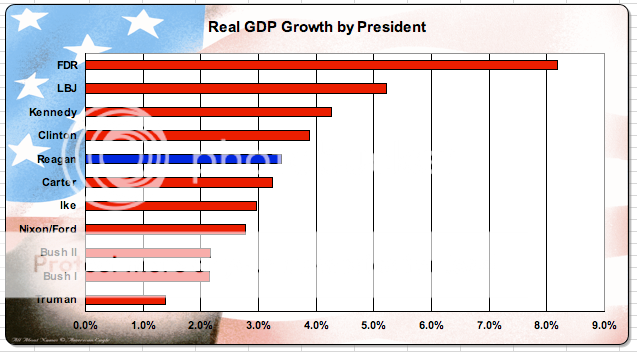

After the last severe recession in the early 1980s, GDP grew at rates of 7 to 9 percent for five straight quarters and the unemployment rate dropped from 10.8 to 7.2 percent in 18 months.

My Way News - Economic rebound slowed last quarter

Reagan growth rates: 7-9%

Obama's growth rates: 3-5% (and cooked with bogus cash for clunkers)

Reagan's Polices are Mo Mo Bettah than Obama's.

Just SAYIN'.

Well, that's what happens when the government increases spending and taxes, grows the size of government relative to GDP by 25% in 18 months, and increases debt to 90% of GDP. Oh, and when so much money is taken from the private sector that it doesn't create Real Productive Jobs and U6 unemployment remains near 17%.

The economic rebound last quarter turned out to be slower than first thought, one of the reasons unemployment is likely to stay high this year.

The economy grew at a 3 percent annual rate from January to March, the Commerce Department said Thursday. That was slightly weaker than an initial estimate of 3.2 percent a month ago. The new reading, based on more complete information, also fell short of economists' forecast for stronger growth of 3.4 percent.

The reasons for the small downgrade: consumers spent less than first estimated. Same goes for business spending on equipment and software. And, the nation's trade deficit was a bigger drag on economic activity.

In a separate report, the Labor Department said Thursday that the number of newly laid off workers filings claims for unemployment benefits fell by 14,000 to 460,000 last week. The decline came after claims had risen by a revised 28,000 in the previous week, the largest gain in three months.

The latest level of claims is slightly higher than it was at the start of the year. That shows the nation's workers are still facing tough times even though the overall economy is growing again.

During normal times, growth in the 3 percent range would be considered healthy. But the country is coming out the longest and deepest recession since the Great Depression. So economic growth needs to be a lot stronger - two or three times the current pace- to make a big dent in the nation's 9.9 percent unemployment rate.

Economists say it takes about 3 percent growth to create enough jobs just to keep up with the population increase. Growth would have to be about 5 percent for a full year just to drive the unemployment rate down 1 percentage point.

After the last severe recession in the early 1980s, GDP grew at rates of 7 to 9 percent for five straight quarters and the unemployment rate dropped from 10.8 to 7.2 percent in 18 months.

My Way News - Economic rebound slowed last quarter

Reagan growth rates: 7-9%

Obama's growth rates: 3-5% (and cooked with bogus cash for clunkers)

Reagan's Polices are Mo Mo Bettah than Obama's.

Just SAYIN'.